Multi-Million Dollar Check Fraudsters Recruited Instagram Users to Deposit Stolen Checks

An image from Carlos Corona’s Instagram account shows a man in a Champion sweatshirt smoking a cigar. Photo from @charliehustle323.

Corona and his accomplices deposited checks stolen from the mail into bank accounts belonging to people they recruited from Instagram.

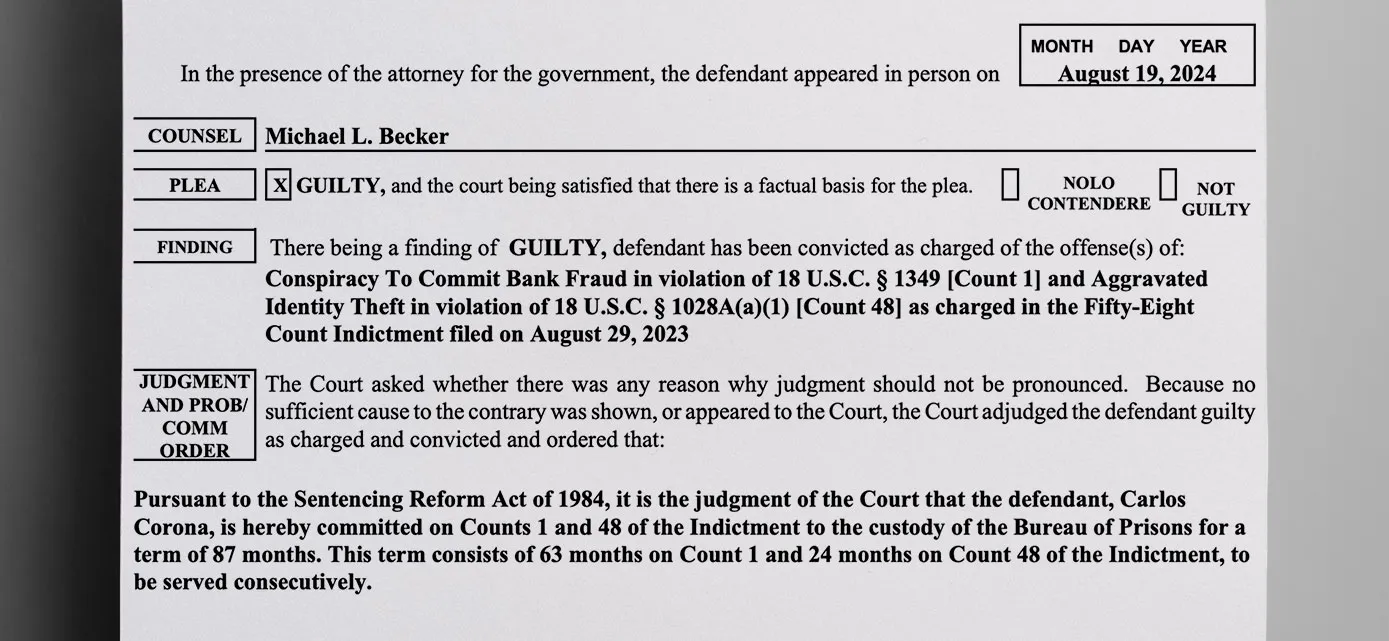

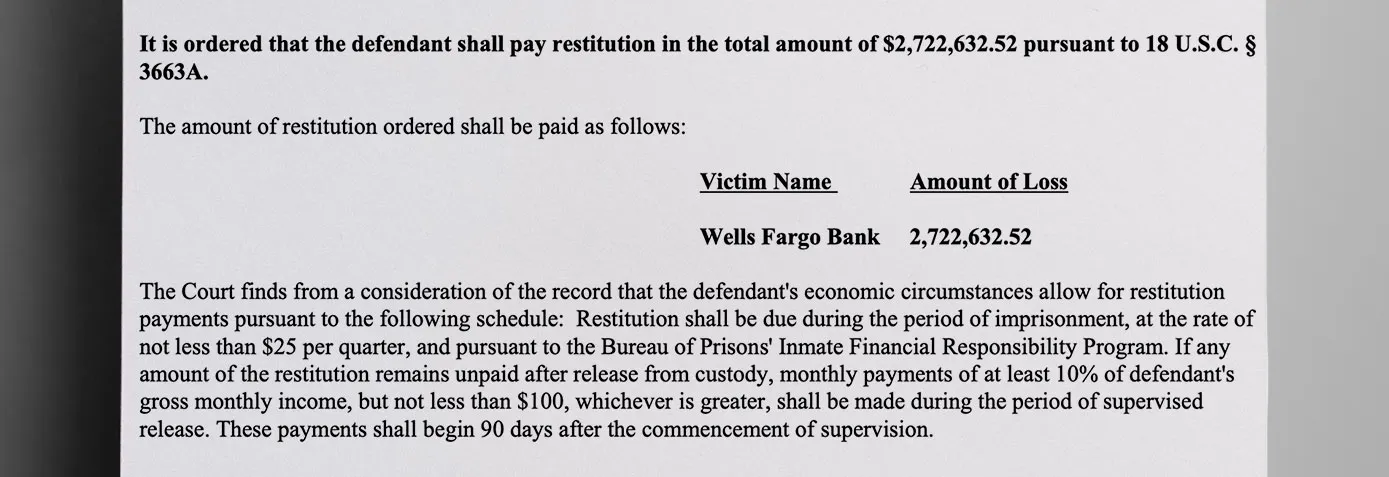

Along with the time in prison, the judge ordered Corona to pay $2,722,632 in restitution. Corona pleaded guilty on May 1 to one count of conspiracy to commit bank fraud and one count of aggravated identity theft, according to a press release by the U.S. Attorney’s Office, Central District of California.

From October 2020 to August 2023, Corona stole checks from the mailboxes, which later were endorsed with forged signatures or altered names and deposited into various bank accounts.

Corona and his co-conspirators, including Jose Luis Edeza Jr., a 31-year-old from Sunland, CA, used Instagram to lure bank account holders by making promises of a cut from the fraudulent deposits in exchange for access to their accounts, according to a previous U.S. Attorney’s Office statement.

Thefts Added Up to Millions

Using this scheme, they managed to take at least $2.7 million, while the investigation showed they had attempted to steal up to $5.3 million. The stolen checks were processed using methods such as false endorsements, altering the names of the original payees, and physically ‘washing’ the checks to remove existing information and then rewriting them for a deposit, after which the funds were rapidly withdrawn or transferred to another account or used to make debit card purchases.

So far, prosecutors have managed to secure 10 convictions in this case.

Along with Corona, Edeza Jr. was previously sentenced to four years and nine months in federal prison after admitting he took part in a conspiracy to commit bank fraud and aggravated identity theft, prosecutors said.

How to Protect Yourself From Check Fraud

The Federal Trade Commission warns that criminals recruit people for wide-ranging check scams by promising them money in exchange for depositing checks– which the recruits may or may not know are stolen, according to an article on the FTC’s webpage. Recognizing these requests as scams will help you avoid getting unintentionally caught in a theft ring.

While no payment methods are completely secure, you can reduce your use of checks and opt for online payment methods that experts say are more secure. Checks may be more susceptible to fraud because they have your name, address and account number– not to mention your signature– which is all the information a fraudster needs to steal your money.

If you do use a check, mailing it in person at the post office is more secure than leaving it in an unattended mailbox.

And, as always, if you suspect attempted fraud on your account, report it immediately to your financial institution and law enforcement.

Discover More Muck

First AI-Powered Lawsuit Exposes California’s Eco-Fraud Empire

Feature John Lynn | Apr 10, 2025

Former Child Soldier General Lied to Get Green Card

Report Strahinja Nikolić | Feb 27, 2025

Weekly Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.

Weekly

Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.