Woman Caught in Multi-Million-Dollar Check-Kiting Scheme

Restauranteur Katherine Mott-Formicola pleaded guilty on Dec. 30 to kiting checks. She faces three decades behind bars.

Mott-Formicola owns Monroe’s Restaurant in Rochester, N.Y. She faces 30 years in prison and a $1 million fine.

What is Check-Kiting?

Check-kiting is the process of artificially inflating the balance of one bank account by writing a check from another bank account that does not have a sufficient balance to cover the check, according to an article by Cornell Law School. The scheme takes advantage of the time it takes for checks to clear, as most banks make the deposited amount available before the clearing date.

Some people use check-kiting to give themselves a quick cash advance before they receive payment or money from another source, while others continue a constant cycle of writing bad checks from different accounts to keep the scheme going, according to Cornell. Someone who keeps the scheme going controls multiple bank accounts and writes a check exceeding the amount in bank account one to bank account two. They then write a check from bank account three to cover the check from bank account one and continue with multiple other bank accounts.

Shuffling Between 17 Bank Accounts

Between Nov. 29, 2022, and March 11, 2024, Mott-Formicola controlled ten bank accounts with Five Star Bank (FSB) and seven bank accounts with Kinecta Federal Credit Union, according to the plea agreement. With these accounts, Mott-Formicola was able to keep the check-kiting scheme going.

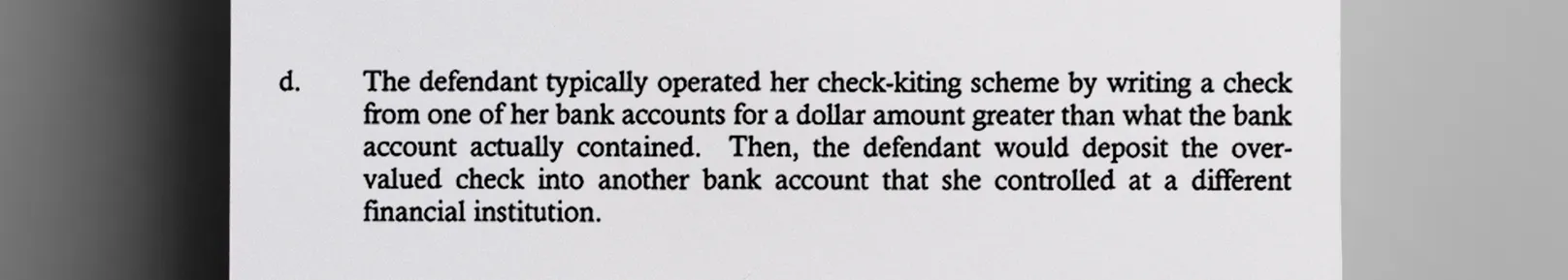

To make the scheme work, Mott-Formicola wrote a check from one of her accounts at one bank for a larger sum of money than was in the account. Then, she deposited that check into a bank account she owned at the other bank, according to the plea agreement.

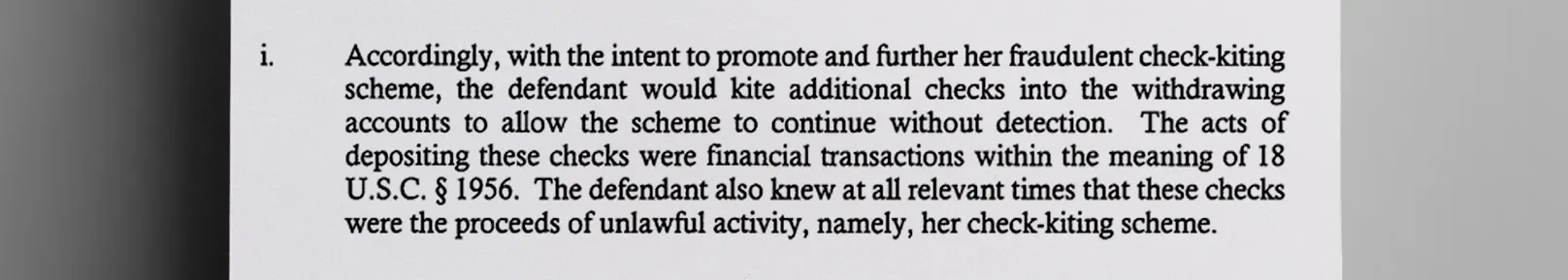

The receiving bank account would see an increased balance immediately, even though there were insufficient funds in the account from which she wrote the check, according to the plea agreement. Mott-Formicola wrote checks from her other bank accounts into the withdrawing account to inflate the drawing account enough to cover the check.

Mott-Formicola continued the scheme, writing over 500 inflated checks between her bank accounts during a one-and-a-half-year period, according to the indictment. Mott-Formicola spent $20,907,000 in funds she over-inflated from her bank accounts on personal items, real estate and other business ventures, according to the DOJ press release.

In March 2024, Kinecta dishonored some inflated checks Mott-Formicola wrote to an account at FSB and charged back the amount, according to the plea agreement. This resulted in a $20,907,000 overdraw on Mott-Formicola’s FSB accounts. Despite confiscating funds from other accounts Mott-Formicola held at FSB, FSB still lost $18,979,005.79 in the scam.

Mott-Formicola Statement

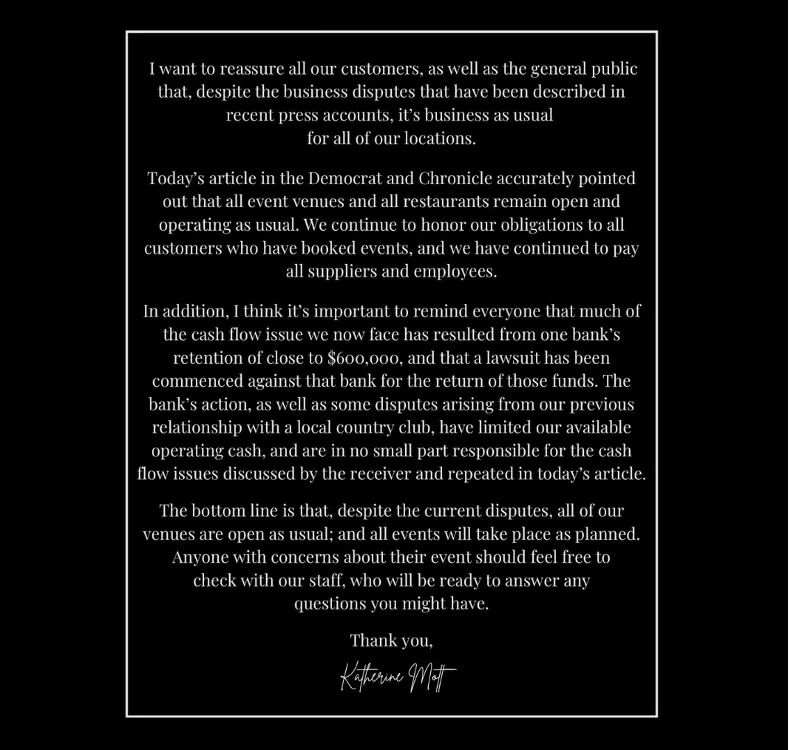

In October, Mott-Formicola published a statement on the Facebook page of Monroe’s Restaurant in Rochester, N.Y., attributing the “cash flow issue” to “one bank’s retention of close to $600,000.”

She further stated in the October statement that she filed a lawsuit against that bank and that all Monroe’s Restaurant locations remain open for business.

Discover More Muck

First AI-Powered Lawsuit Exposes California’s Eco-Fraud Empire

Feature John Lynn | Apr 10, 2025

Former Child Soldier General Lied to Get Green Card

Report Strahinja Nikolić | Feb 27, 2025

Weekly Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.

Weekly

Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.