Arizona Elected Official Stole $38 Million from Santa Cruz County

Former Santa Cruz County, Ariz., Treasurer Elizabeth Gutfahr sits in a federal court while being tried for embezzling $38 million.

Gutfahr pleaded guilty to three counts and could get up to 35 total years in prison, according to the DOJ press release and her plea agreement. Gutfahr’s sentencing is scheduled for Feb. 6.

Previous Accounting and Real Estate Experience

Gutfahr had experience as an accountant and worked for a real estate company before being elected treasurer in January 2013, according to the indictment. Once elected, Gutfahr became the signer of the county’s Chase checking and savings accounts and was tasked with collecting real and property taxes.

Multiple Business Banking Accounts

Gutfahr had a real estate license from 2008 to 2012 under the business name “Rico Real Estate and Consulting” and opened a business account at Wells Fargo under the same business name on Feb. 3, 2011, according to the indictment. The business, however, was never registered with the Arizona Corporation Commission, nor was it assigned an Employer Identification Number (EIN) with the IRS. This account was closed in March 2024.

On May 24, 2019, Gutfahr created the Double D Cattle Company of Santa County, LLC, and opened a business account at Wells Fargo Bank under that name, according to the indictment. On Oct. 15, 2019, Gutfahr created the Rancho San Cayetano, LLC, which served as a horse boarding facility. Gutfahr’s personal residence was there, and she opened a business checking account for the company.

On Jan. 29, 2024, Gutfahr opened a BMO business checking account under Rio Rico Consulting, as detailed in the indictment.

Transferred Money from County to Business Bank Accounts

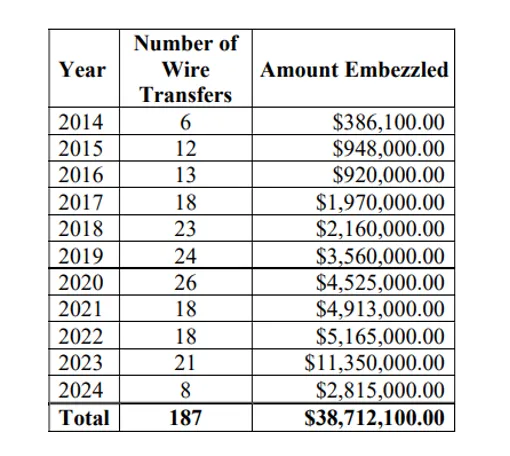

Between March 13, 2014, and March 28, 2024, Gutfahr initiated around 187 wire transfers from the county’s Chase Bank accounts to her Wells Fargo and BMO accounts, according to the indictment. The amount stolen from Santa Cruz County was more than $38 million.

Gutfahr sent most of the wires to her Wells Fargo account until she opened the BMO account in January 2024, according to the indictment. Gutfahr also circumvented the two-step approval process, where the Chief Deputy Treasurer would initiate a wire transfer using a computer token assigned to the Chief Deputy. Gutfahr could skip this step by using the token herself and then approving the transactions.

False Claims and Records

Gutfahr tried to justify her use of the Chief Deputy’s token by falsely claiming that the Wells Fargo account was a savings account that earned interest for the county, according to the indictment. Gutfahr also made false statements on reports to make it look as if the spending was legitimate and, from 2018 to 2023, inflated cash expenditures and reconciliation balances to conceal the theft.

Around 97% of all deposits into Gutfahr’s Wells Fargo account were money taken from the Santa Cruz County account to enrich herself, the indictment details. Gutfahr used the money to purchase expensive real estate properties, writing checks and withdrawing funds from her Wells Fargo and later her BMO accounts to complete the purchases.

Didn’t Pay Taxes on Stolen Money

Gutfahr also didn’t claim the money she stole between 2014 and 2024 in her tax returns, so she owes $13,143,526.00 in back taxes to the IRS, according to the indictment.

Discover More Muck

First AI-Powered Lawsuit Exposes California’s Eco-Fraud Empire

Feature John Lynn | Apr 10, 2025

Former Child Soldier General Lied to Get Green Card

Report Strahinja Nikolić | Feb 27, 2025

Weekly Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.

Weekly

Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.