Another Dual U.S.-Iranian Citizen Arrested in Sanctions-Evasion Scheme

Kambiz Eghbali, who also goes by Cameron Eghbali, 50, living in Los Angeles, was arrested on Oct. 7 on conspiracy, bank fraud and money laundering charges, according to a DOJ press release. Hamid Hajipour and Babak Bahizad, who are Iranian nationals living in Iran, have also been charged but have not yet been arrested.

International Emergency Economic Powers Act

In addition to money laundering and bank fraud, prosecutors have charged the three men with violating the International Emergency Economic Powers Act (IEEPA), which was created in 1977 under President Jimmy Carter and allows the president to declare a national emergency if there is an “unusual and extraordinary” threat to U.S. foreign policy, the economy or national security.

Under the act, presidents can control, restrict and freeze foreign transactions and assets under the jurisdiction of the United States. The Treasury Secretary then created the Iranian Transactions and Sanctions Regulations (ITSR) under President Bill Clinton in 1995, which prohibited all sales and exports of goods and services to Iran from the U.S.

Eghbali is a dual citizen of Iran and the U.S. and the Chief Executive Officer of a videogame wholesale and distribution company in North Hills, California, according to the indictment. Hajipour owns a financial transactions company specializing in business between Iran and the U.S., and Bahizad is an employee of a company specializing in importing gaming products from the U.S. Hajipour and Bahizad reside in Iran.

As The Daily Muck noted in a previous story, another dual U.S.-Iranian citizen was arrested on Aug. 30 for allegedly smuggling airplane parts and drilling machinery components from the U.S. to Iran. Sanctions against Iran make it illegal to trade with Iran without OFAC authorization. To get approval, businesses or individuals must apply with the Office of Foreign Assets Control.

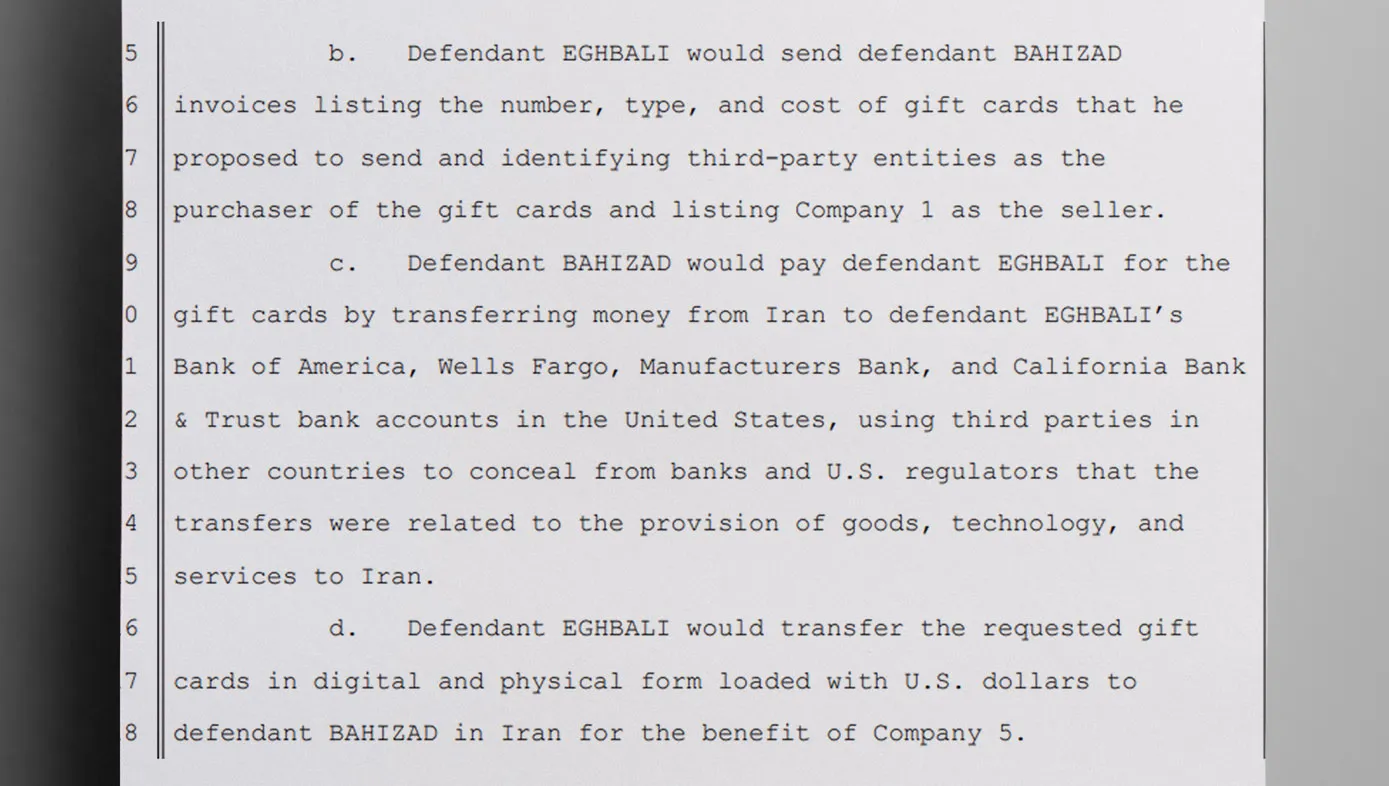

Transferring Money Via Gift Cards

Prosecutors alleged that between March 2014 and September 2019, none of the defendants applied for an OFAC license before Bahizad allegedly sent orders for digital and physical gift cards to be loaded with U.S. Dollars to Eghbali from Iran. Eghbali would send back an invoice telling Bahizad how much he would send and the cost, then Bahizad used third-party entities in other countries to transfer money from Iran to Eghbali’s various American-based bank accounts, according to the indictment. Once the invoice was paid, Eghbali would load the gift cards with U.S. dollars and send them to Bahizad in Iran.

Eghbali also allegedly sent gift cards loaded with U.S. dollars to Hajipour, who would then send money to Eghbali’s bank accounts in the same manner, violating the sanctions the U.S. issued against Iran, according to the indictment.

If convicted on all six counts in the indictment, Eghbali could receive a maximum total of 70 years for bank fraud, money laundering and violating sanctions against Iran, according to the DOJ press release. Bahizad and Hajipour still live in Iran and have not been arrested for participating in the scheme.

Discover More Muck

International Cyber Op Wipes Chinese Malware From Thousands of Computers

Report Strahinja Nikolić | Feb 27, 2025

Government to Crack Down on Foreign Adversaries Stealing Americans’ Personal Data

Report Matthew Koelher | Feb 10, 2025

Wannabe Hizballah Recruit Indicted for Lying to the FBI

Report Jessika Saunders | Feb 6, 2025

Weekly Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.

Weekly

Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.