Colorado Business Woman Withheld Taxes from Employees, Never Paid IRS

Colorado businesswoman Shandel Arkadie pleaded guilty to failing to pay more than $1.5 million in employment taxes she had withheld from employee paychecks.

Arkadie owned and operated the Colorado limited liability company Alternative Choice Home Care, according to the indictment. Court documents listed Arkadie as the sole member of the company.

Arkadie is scheduled to be sentenced on May 15. She faces a maximum term of five years in prison.

Arkadie’s Company Provided Home Health Care Services

Alternative Choice provided in-home health care services, according to the indictment. From around Jan. 1, 2015, to around Dec. 31, 2020, Alternative Choice had employees working for the company.

Alternative Choice paid the employees and withheld taxes from their paychecks, according to the indictment. The taxes withheld from the paychecks included federal income taxes, Medicare and Social Security. These taxes are called “trust fund taxes.”Arkadie was also supposed to match the amounts of funding withheld from the employees for Social Security and Medicare in addition to paying trust fund taxes, collectively called employment taxes, according to the indictment.

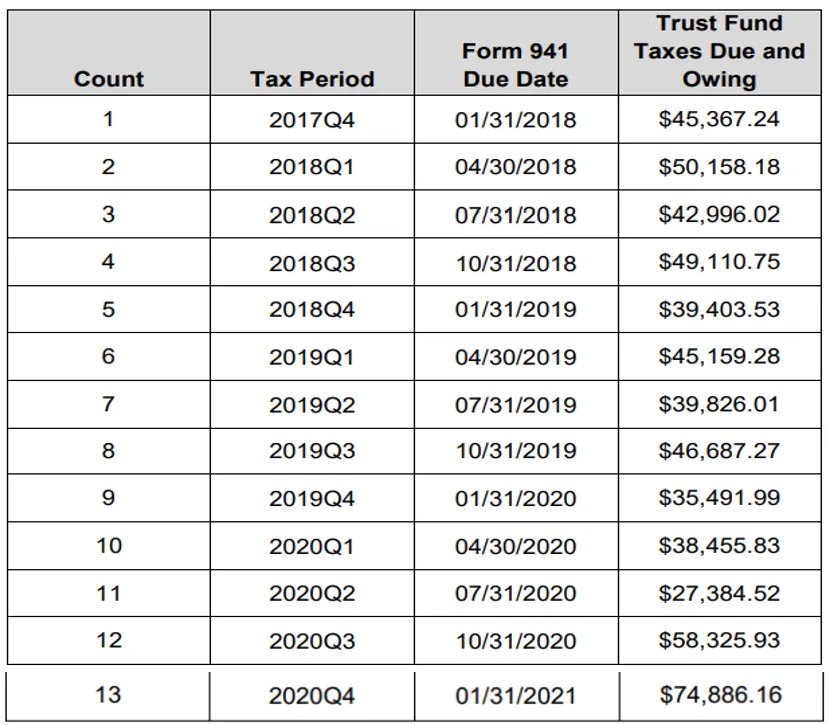

Every quarter of the year, Alternative Choice was required to fill out an Employer’s Quarterly Federal Tax Return, “Form 941,” conveying the total amount of Medicare and Social Security due, the amount of trust fund taxes withheld from the employees, and the total taxes paid by the company, according to the indictment. The deadline to file Form 941 is the last day of the month after the last day of the previous quarter.

Failed to Pay Taxes She Collected from Employee Checks

Arkadie was responsible for hiring and firing employees, signing checks, authorizing payroll payments, filling out Form 941, and paying the IRS, according to the indictment. Arkadie failed to pay these taxes, owing over a million dollars between the fourth quarter of 2017 and the fourth quarter of 2020.

Arkadie pleaded guilty to all 13 counts of willfully failing to pay back employment taxes, according to her plea agreement. The plea agreement showed Arkadie’s tax liability from the first quarter of 2015; however, the 13 counts in the indictment did not start until the fourth quarter of 2017.

Arkadie will pay the IRS $1,588,185.68 in restitution, covering everything owed from the first quarter of 2015 to the fourth quarter of 2020, according to the plea agreement. The judge ordered a lien on all properties for as long as 20 years or until the restitution is paid back in full.

Discover More Muck

First AI-Powered Lawsuit Exposes California’s Eco-Fraud Empire

Feature John Lynn | Apr 10, 2025

Former Child Soldier General Lied to Get Green Card

Report Strahinja Nikolić | Feb 27, 2025

Weekly Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.

Weekly

Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.