Feds Going After Gig Workers for Taxes

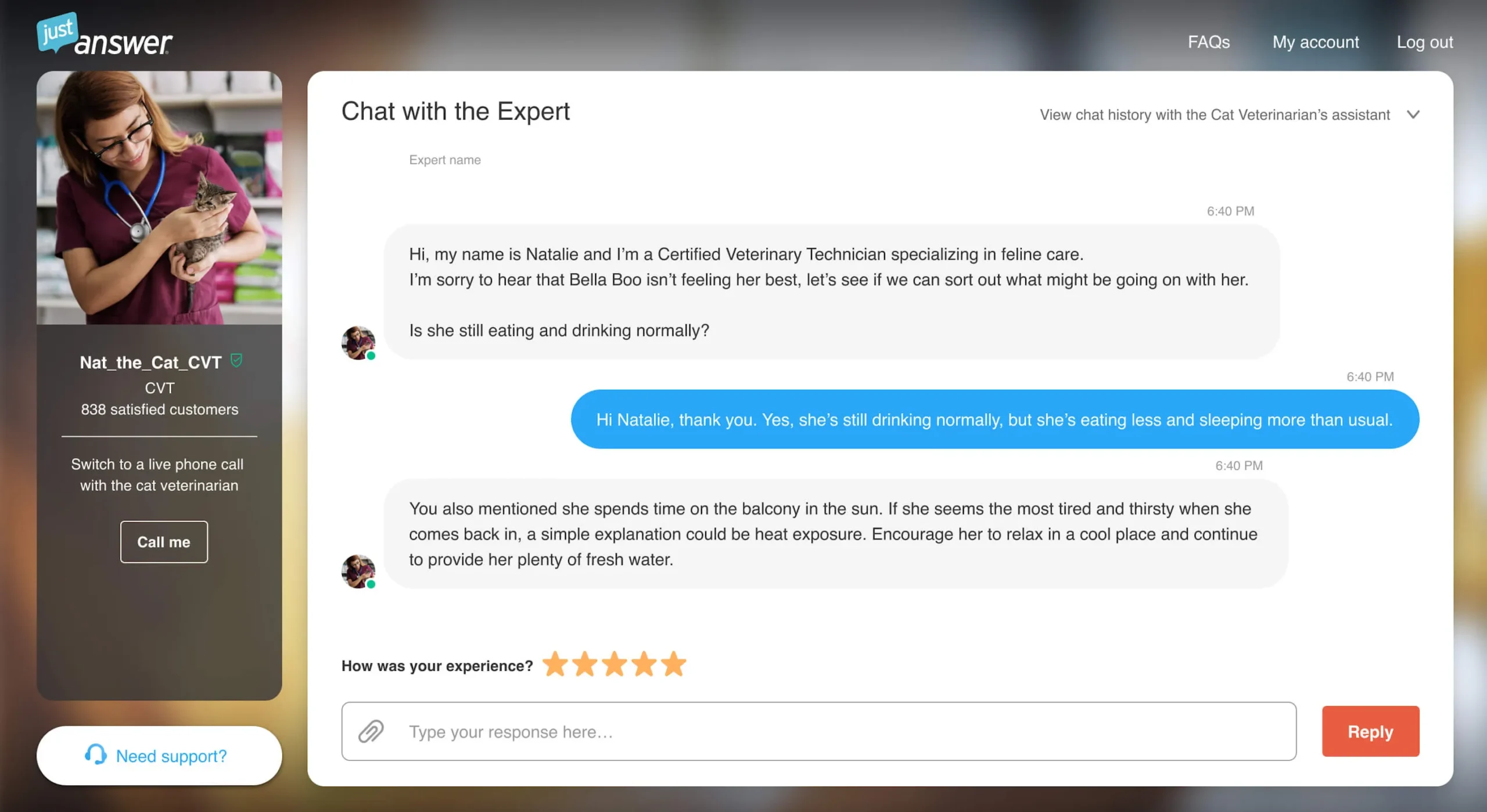

JustAnswer.com offers users the chance to chat with experts. Now the IRS wants to make sure those experts are reporting their income. Photo credit: JustAnswer.com press kit.

The IRS is trying to get records of individuals who were paid by JustAnswer, a digital platform that enabled its members to pay and have their questions answered by a wide array of professionals, like doctors, lawyers, engineers, veterinarians and tax consultants, according to a new Justice Department press release.

JustAnswer was founded in 2003 in California. It claims to be one of the biggest platforms that offers expert answers on any topic needed.

The federal court action was initiated under the Biden administration. It is unknown if the Justice Department’s pursuit of JustAnswer will continue under the Trump administration.

Gig Economy

The Justice Department describes JustAnswer as part of the “gig economy,”– a place where users can earn money by providing on-demand work, services or goods through a digital platform.

Other examples of gig economy platforms are Airbnb, Uber, Lyft, DoorDash, Etsy and TaskRabbit. These platforms are associated with smartphones because they allow easy access to digital platforms that then serve as intermediaries that connect sellers and service providers with customers while also being responsible for payment processing.

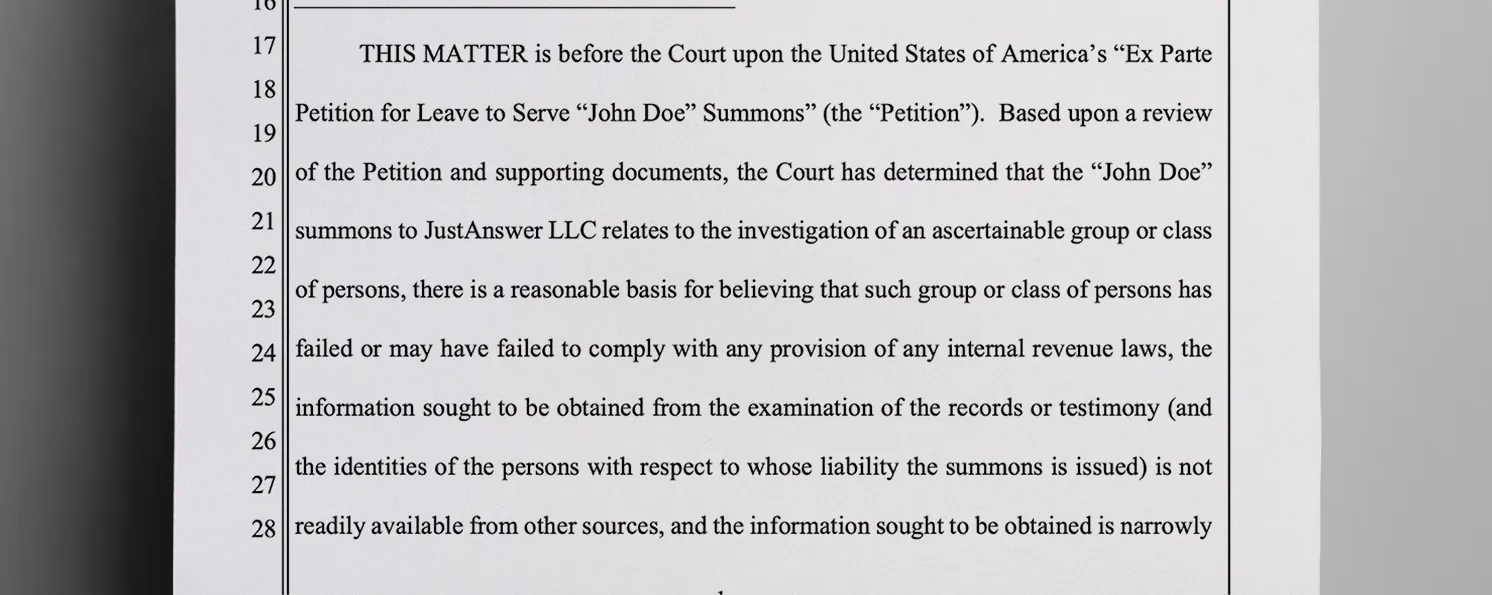

The Justice Department clarified in its statement that there is no indication that JustAnswer did anything wrong. The intent of the summons, it says, is to get the information about who possibly violated internal revenue laws by not reporting the income they received from the platform.

This John Doe summons directs JustAnswer to produce records identifying U.S. taxpayers who have used its platform to earn income, along with other documents relating to their work.

Official Statement

Deputy Assistant Attorney General David Hubbert of the Justice Department’s Tax Division highlighted the importance of making sure U.S. residents pay taxes on all of their income.

“The gig economy has grown in recent years and with it, the concern for tax compliance issues has increased,” Hubbert said. “This John Doe summons demonstrates that working with the IRS we will use all the tools available to us to ensure that no matter how U.S. taxpayers earn income, they are properly reporting it and paying their taxes.”

Danny Werfel, IRS Commissioner, stated that those who earn from digital platforms have the same responsibilities to pay income tax as everyone else.

“Like their fellow Americans who earn income through traditional means, U.S. taxpayers who earn income from digital and other platforms that comprise the gig economy need to pay their fair share of taxes,” said Warfel. “The world is getting smaller for tax cheats, and we will work collaboratively with our partners to vigorously enforce the nation’s tax laws.”

Discover More Muck

Induced Into Harm: When Doctors and Hospitals Betray Mother and Child

Feature Raymond L. Daye | Jun 11, 2025

Weekly Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.

Weekly

Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.