Felon Indicted for Financial Fraud… Again

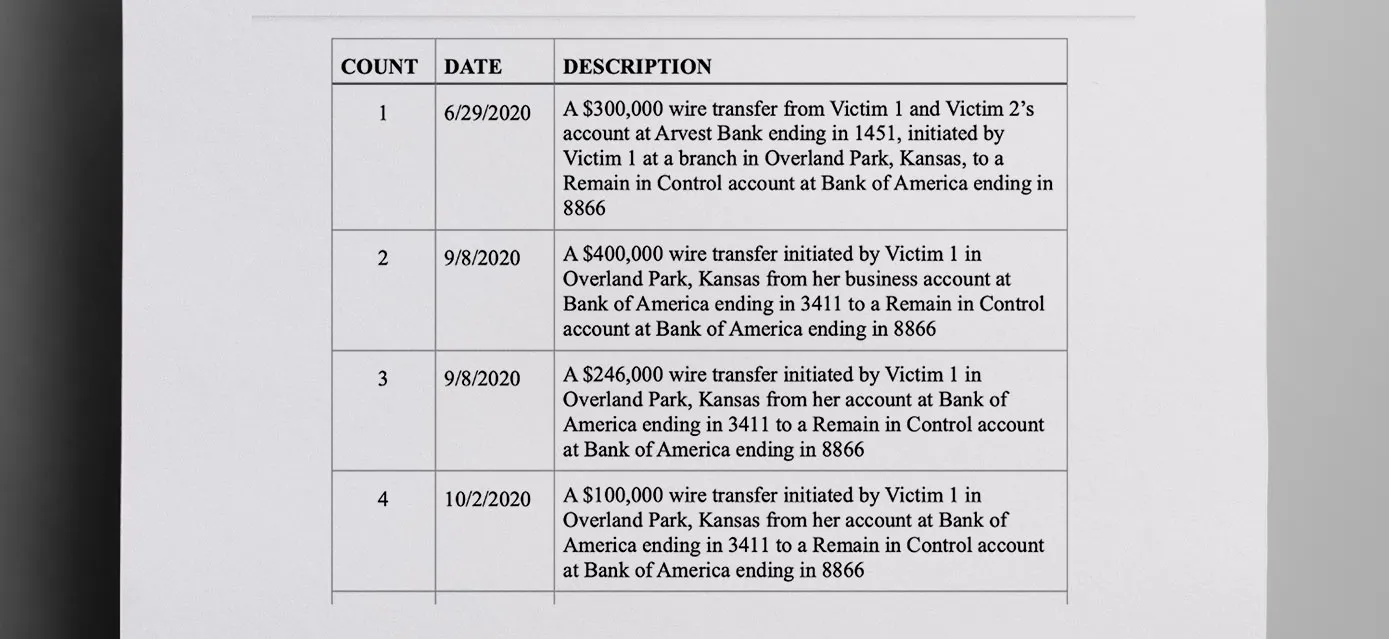

Prosecutors have charged Roman with eight wire fraud counts and four of money laundering, according to a press release by the U.S. Attorney’s Office, District of Kansas.

Authorities allege Roman used his Tennessee-based company, Remain in Control, to persuade individuals to invest in high-yield investment programs. Victims would transfer their money to his company under false pretenses, which he would use for his own and other people’s benefit without his clients’ knowledge or consent.

Roman paid “returns” to some of his victims in order to induce them to invest more money in his fraudulent schemes, according to his indictment. By doing this, Roman, “sought to lull his victims into a false sense of security, postpone inquiries or complaints, and make his investment scheme seem less suspect,” say prosecutors.

With alleged thefts topping $1 million, Roman defrauded individual investors of up to $400,000, according to the charges against him, according to his indictment.

Previous Fraud Conviction

This was not the first time Alcides Roman was arrested for fraud.

In 2013, the then 53-year-old was found guilty of defrauding $340,000 from individuals in Louisiana seeking business loans, according to a press release by the U.S. Attorney’s Office, Western Louisiana.

Using a company called Amstar Investment Properties, Roman misused money from two different wire transfers, according to prosecutors. Victims paid Roman an upfront fee in exchange for securing financing worth millions of dollars. When the money never came through, Roman didn’t pay the victims back their advance fees, as promised. .

For this crime, he was sentenced to 41 months in prison with three years of supervised release. Along with the sentence, United States District Judge Tom Stagg ordered Roman to repay his victims $340,000.

During the trial, the judge asked Roman about reports of similar problems. Roman acknowledged that he owes money to people in Florida, too. “People who have, unfortunately, also were not paid on time and were owed money because of my company going bankrupt and investments not paying off,” said Roman, according to an analysis of the case. “Unfortunately, I wasn’t able to pay them back either. So yes, I do have people pending that I owe money to as well.”

“People who have, unfortunately, also were not paid on time and were owed money because of my company going bankrupt and investments not paying off,”

said Roman, according to an analysis of the case.

How to Protect Yourself From Financial Scams

You can take steps to protect yourself from a possible scam.

First, make sure you deal with a trusted company. Check online review sites for reports about others’ experiences.

If something seems off about the way they ask you to transfer money– like asking for an upfront fee to secure a loan package, which isn’t standard–consider walking away and choose another company for your needs.

Discover More Muck

First AI-Powered Lawsuit Exposes California’s Eco-Fraud Empire

Feature John Lynn | Apr 10, 2025

Former Child Soldier General Lied to Get Green Card

Report Strahinja Nikolić | Feb 27, 2025

Weekly Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.

Weekly

Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.