Ignorance, Empathy and Prosecutorial Overreach: Why Good Doctors Do Bad Things in the Eyes of Medicare

In the government’s eyes, fraud is fraud. Some doctors and patients point out that Medicare’s confusing and sometimes vague rules and regulations on how to file claims and what medical procedures are and are not covered can cause– in baseball parlance– forced errors.

Medicare’s labyrinthine regulations may also tempt good-hearted physicians to take shortcuts or engage in “creative definitions” to treat patients who rely on Medicare to pay for health care.

Make no mistake. Medicare fraud is a scourge that must be stamped out. Unlike smallpox and polio, the only vaccination for this disease is aggressive prosecution and consistent punishment for offenders who are caught with their surgical gloves in the cookie jar.

The Daily Muck has covered numerous Medicare fraud cases and wholeheartedly applauds these efforts. But we also were stumped by why so many ostensibly good people– medical professionals– get caught doing so many bad things– fraud.

This article looks at the hurdles doctors face in complying with the rules and patients’ problems in receiving needed care that isn’t covered by the government program.

Medicare fraud is a felony that carries substantial penalties. Those convicted can be fined up to $250,000, sentenced to as long as 10 years in prison, and be forced to reimburse the government for the costs of the fraud.

Rural Doctor Says ‘Advantage’ Plans ‘Are a Nightmare’

Medicare is not just a big city problem – even though they may have a higher volume due to a larger population. Small, rural areas are just as affected – and some say even more so.

Dr. James Bordelon practices in Marksville, a small city in rural Louisiana. He is vice chief of staff at Avoyoyelles Hospital, a general surgeon and coroner of Avoyelles Parish.

Bordelon said Medicare rules are complicated and coverage issues exist, but both can usually be overcome by “knowing the laws inside out and coding your diagnoses correctly.”

Medicare Advantage Plans Cause Big Problems

The biggest problem doctors face in Medicare are the “Medicare Managed Plans, also called Advantage plans,” Bordelon said. “These are much more complicated than traditional Medicare, especially in post-acute care like rehab, home health and hospice.”

He said coverage denials are more common and claims documentations more demanding under the Advantage plans.

“It requires extra staff just to handle the claims process,” Bordelon said. “I have patients who have to spend extra days in the hospital waiting for approval for rehab or home health care. I have one right now who has been in the hospital for six days and is supposed to be limited to seven days total, waiting for rehab approval.

“These Medicare Advantage plans are a nightmare for patients,” he said. “They are given a lot of promises about extra benefits but are not told the limitations on health care coverage.”

A problem a rural hospital or provider faces is the Medicare plan representatives “being unfamiliar with the logistics of a facility, especially a rural facility. They seem to think every hospital is like M.D. Anderson. I end up having to call them up to talk to someone to explain the situation and why it has to be done that way. It is usually resolved, but that’s 30 minutes out of my day that I have to try to make up in my schedule.”

Bordelon has been in private practice since 2002 and has been “a stickler for the rules since the first day I opened my door. I didn’t want a Medicare violation on my record when I was just starting out.”

He said younger providers may have trouble if they are not super-careful in learning and understanding the Medicare regulations.

More Paperwork and Documentation

And it seems that Medicare is getting harder to deal with as time goes on, not easier.

“One thing that has changed is that Medicare requires a lot more paperwork and documentation when filing a claim,” Bordelon said.

A large reason for this is the government’s Merit-based Incentive Payment System (MIPS), which determines a provider’s Medicare payment rate. The government “scores” the medical providers in four areas – quality measures, cost measures, health information technology use and practice improvement activities, the American Medical Association explains in an October 2023 article on the program.

Each participating provider is given a score of 0-100 based on that information. Those scoring over 75 in 2023 would be expected to receive a bonus of 3.71 percent in 2025. Those scoring less than 75 would be penalized up to 9 percent based on their score.

MIPS uses a “tournament model” to control its costs, using penalties to pay for the bonuses.

The AMA noted in the article that the report based on the 2023 data would be used to set the physicians’ payment rate for 2025. The organization estimated that 308,000 clinicians’ scores would fall below 75, with about 75,000 facing a MIPS penalty of between 3 and 9 percent.

Heart Vs. Head

It would be untrue to say rural doctors care more about their patients than metropolitan physicians. However, when there is a high likelihood that your patient is related to you – by blood or marriage – or attends the same church you do, the doctor-patient dynamic is a little different.

Bordelon admitted that frustration with a coverage issue can result in “the heart coming over the head sometimes. As a doctor, you just have to be careful that you don’t cross a line. I have to say that some Medicare regulations don’t make sense. We are trying to change those at the corporate and professional organization levels.”

A physician’s “prime directive” – as Capt. Kirk might say – is “to look out for the patient,” Bordelon said. “It is even more important now than before because of changes made to combat the rampant abuse and fraud. What has happened is that patients suffer.

Bordelon said he operates within the laws but has found two things help him satisfy both his “head” – knowing the proper procedures and requirements – and his “heart” – “taking care of my patient’s needs.”

First is to be familiar with the correct medical coding when filing a claim. The code should be as detailed as possible to better ensure the insurance company does not have a problem agreeing that the treatment performed is consistent with the diagnosis.

Another important thing for a physician “is to have a billing company you trust. I have used the same billing company for 17 years that keeps me straight. They are aware of the evolution of Medicare over the years and they keep me up to date with that stuff.”

Attorneys Help Doctors Navigate Medicare Laws

Houston attorney Seth Kretzer has a long and successful track record in helping doctors navigate the tricky Medicare rules and regulations.

“The problem is that because of the vagaries of Medicare law, many doctors and their offices may not know that they’re doing anything illegal,” Kretzer noted in a May 2022 blog on the subject. “You might be running afoul of a law that you didn’t know existed.”

Kretzer said the government monitors Medicare billing closely. If potential fraud is detected, doctors “may receive a letter from the federal government asking you to surrender some of your billing and treatment records. Receiving that kind of communication can be very frightening for medical practitioners and their offices.

“If you fail to prove to the government’s satisfaction that you haven’t abused Medicare, you might be fined large sums of money, face action from your state’s medical board, and even be denied the right to bill Medicare in the future,” he added.

The attorney, not surprisingly, says the best way to “avoid that sort of legal nightmare” is to hire an attorney familiar with Medicare “as soon as you start taking patients who are on Medicare. This way, you’ll receive special guidance before you start about common pitfalls in billing and other practices. You’ll also have an expert on hand who can review your practices as you go to let you know you’re doing everything above board.”

Ignorance is a Better Defense Than Empathy

Kretzer’s experience lands heavily on the “ignorance” side of this article’s title.

“Unfortunately, there’s no place on the form the doctor is given for them to say, ‘Look, I had a really magnanimous reason for doing that,’” Kretzer told The Daily Muck. “The feds don’t want to hear that and they don’t care.”

He said he has never presented a defense based on “he had a good reason for doing it. I have had clients who wanted to say they have donated so much free medical services to the needy in the community, traveled to Africa or South America to provide medical services, operated on children with cleft palates, and other good works. It doesn’t matter. All the prosecutor looks at is what was done and if it violates the law.”

Although the symbol of Lady Justice is the blindfolded maiden holding a scale, whether the defendant’s good works outweigh his bad is not a factor in determining his guilt or innocence, Kretzer added.

The attorney said he feels bad for doctors who thought they were doing things the right way and then get charged with fraud.

“Frankly, some of these codes are so confusing that God Almighty doesn’t even know what they mean,” Kretzer said. “Often, doctors are horrible businessmen. They do their work and take care of their patients.”

Sometimes they hire a third-party vendor to handle the billing duties, and then have to trust that it is done right.

He said he has had cases where the fraud prosecutor “will just walk away” after receiving a full explanation of what happened and how it happened. “Other times, they get a hair up their butt and go after them, regardless. It’s really random.”

In cases where the doctor unintentionally committed fraud, “It comes down to the doctor having to stand in front of a jury and say how dumb they are,” Kretzer said. “The problem with that is jurors often don’t buy it. They believe doctors, lawyers, bankers and such must be really smart or they wouldn’t have those jobs.”

Another line of defense doctors may want to use is to point out “how many times I did it right. The court will not let them argue that 90 percent of the medical codes they submit are accurate. They only want to determine if the records in the case are accurate or fraudulent.”

Upcoding and Conspiracy

Kretzer said most of the cases he’s seen involve violations known as “upcoding.” Many times this is intentional and, if the feds are involved, has occurred frequently enough to be flagged as a pattern over several years. Sometimes it’s unintentional.

“An example of upcoding would be a dentist performing a teeth cleaning and then billing Medicare for a tooth extraction,” he said. “Most of the time it is fairly obvious what is going on.”

Kretzer said most of his clients “are very smart. They think they know the law. They will tell me, “Everyone I know does it like this.’ I’m sure that’s true, but it doesn’t matter to the court.”

Another potential problem is avoiding the appearance of “conspiracy to commit fraud,” he said. This doesn’t have to involve clandestine meetings and well-planned plots.

“It can be as innocent as one line in one email,” the attorney continued. “A line such as ‘Teamwork makes the dream work’ could be construed as being complicit in a plan to commit fraud with another provider suspected of perpetrating a fraud.

“Be careful what you put in an email,” he continued. “There’s an old saying in politics, ‘I can handle my enemies, but God save me from my friends.’”

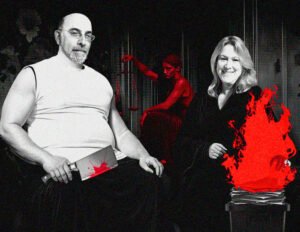

Ganji and Davis: A Lack of Intent

Despite the old adage quoted earlier, sometimes ignorance of the law CAN be a way to avoid conviction for Medicare fraud. Sometimes, though, a court may convict them anyway. In those cases, all hopes rest in the appeals process – which in the federal court system can take several months or years just to come before an appeals court that may or may not overturn the lower court’s decision.

One such incident was the case of Dr. Pramela Ganji and Christian Home Health owner Elaine Davis in New Orleans. The two women were convicted of Medicare fraud in March 2016 and sentenced to prison in October of that year -– Davis to 96 months and Ganji to 72 months, as reported in DOJ press releases in March and October 2016. Their convictions and sentences were overturned by the 5th Circuit Court in January 2018.

The two women were released from prison after serving almost a year of their sentences. Ganji was 67 at the time of her sentencing. Davis was 60.

Ganji’s attorney, David Oscar Markus of Miami, responded to the appellate court’s decision by telling NOLA.com, “It is very dangerous to be a doctor these days. If you are a doctor billing Medicare or Medicaid, you have a big target on your back.”

What Happened in Ganji-Davis

In this case, the government alleged the women were part of a scheme that defrauded Medicare of approximately $34 million. In addition to the prison terms, Ganji was ordered to pay over $5 million in restitution, and Davis was ordered to return over $9.3 million to Medicare.

In its Jan. 30, 2018 ruling, the U.S. 5th Circuit overturned and vacated their convictions and sentences, ruling the prosecutors “failed to present evidence that allowed any rational juror to infer the existence of a conspiratorial agreement beyond a reasonable doubt” or “to show an agreement to defraud Medicare beyond a reasonable doubt.”

After dismissing the conspiracy charges, the court turned to the actual fraud itself. The justices noted that to prove health care fraud, “the government must show that a defendant knowingly and willfully executed ‘a scheme or artifice — (1) to defraud any health care benefit program; or (2) to obtain, by means of false or fraudulent pretenses, representations, or promises’ any health care benefit program’s money in connection with the delivery of or payment for health care services.”

As to Ganji, the 5th Circuit pointed out that “Medicare guidelines do not prohibit treating physicians who are not primary care physicians from beginning the home health care process. Therefore, Dr. Ganji cannot be held liable for fraudulence as a result of activity that is legal.”

When considering that charge against Davis, the court said the “government based Davis’s fraud completely on the actions of Dr. Ganji. It provided no evidence of Davis’s own fraudulent activity” and concluded there “was not sufficient evidence to show an agreement to commit

health care fraud.”

Attorneys Say This Case ‘Not Unique”

Markus and his co-counsel and wife Mona Markus wrote an article for KevinMD a month later.

“The unjust prosecution of Dr. Ganji is not unique,” they wrote. “Because the Medicare system is so open to fraud and because there is so little oversight, there have been many righteous prosecutions of abusers who don’t provide actual services, overbill, and so on. But the government has cast its nets so wide that it is now prosecuting doctors for federal crimes when there is a simple disagreement on whether the services are medically necessary. This is wrong.”

The attorneys noted a few recent victories where doctors were exonerated, but even a victory “took awful tolls,” including damaging their practices and reputations.

“Judges around the country must continue to push back on these unjust prosecutions,” they said. “Doctors must continue to stand up and fight for their innocence. Most importantly, prosecutors must realize that not every doctor who they disagree with is a criminal.”

“The vast majority of doctors are good people trying to help their patients,” the Markuses continued.”They should be given the benefit of the doubt.”

Home Health: A Prime Area for Problems

As the attorneys above noted, most instances of doctors “doctoring” Medicare diagnosis and treatment claims involve intentional fraud or are due to misunderstanding the laws and guidelines.

Doctors who may want to help a patient receive coverage for something not covered are not likely to risk huge fines, prison terms and/or loss of their careers for even the most altruistic of reasons. They may want to – and they may have to wrestle their better angels not to – but the human instinct of self-preservation is tough to overcome.

Home health care is especially ripe for criminal fraud, legal misunderstandings and possibly “well-intentioned” misuse.

The Center for Medicare Advocacy (CMA) states that while home health coverage is “an important resource for Medicare beneficiaries who need health care at home,” the laws concerning this care pose several pitfalls for doctors and their patients.

Medicare makes home health coverage available for people with acute and/or chronic conditions to provide services to improve, maintain, or slow the decline of the individual’s condition – even if treatment is required for an extended period, the CMA said in an April 2021 article.

“Unfortunately, however, people who legally qualify for Medicare coverage frequently have great difficulty obtaining and affording necessary home care,” the organization continued. “There are legal standards that define who can obtain coverage and what services are available.”

The CMA said Medicare’s criteria for home health “are often narrowly construed and misrepresented by providers and policy-makers, resulting in inappropriate barriers to Medicare coverage for necessary care. This is increasingly true for home health aide services -– the very kind of personal care services vulnerable people often need to remain safely at home.”

‘Unfairly Repudiated Access’ to Care

In assessing the impact of these issues, the CMA said, “All too often, older adults and people with disabilities are unfairly denied access to necessary, Medicare-covered home health care. As a result, they and their families suffer.”

CMA said it “hears regularly from people who meet Medicare coverage criteria but are unable to access Medicare-covered home health care or the appropriate amount of care.” These include those with long-term, debilitating conditions.

“For example,” the organization states in its article, “patients have been told Medicare will only cover one to five hours per week of home health aide services, or for only one bath per week, or that they aren’t homebound (because they roam outside due to dementia), or that their condition must first decline before therapy can commence (or recommence). Consequently, these individuals and their families struggle with too little care or no care at all.”

This regulatory minefield can trap a doctor who truly believes he understands the rules, only to find out he doesn’t. It is also possible to entice a kind-hearted, patient-first physician to “fudge a little” to benefit a Medicare recipient.

The intent is not to defraud but to provide the care their patient requires.

Please Define ‘Homebound’

The Center for Medicare and Medicaid Services (CMS) revised its manual concerning home health care in March 2017, ostensibly to make the issue of “confined to home” more readily understandable. Two criteria are used to determine if the patient is homebound and qualified for home health care.

The first is that they cannot move without supportive devices such as crutches, canes, wheelchairs or walkers– or that they require special transportation or the assistance of another person. This also includes having a “condition such that leaving his or her home is medically contraindicated,” such as a heart condition where even minimal exertion could be fatal or with a suppressed immunity system due to chemotherapy.

The second criterion for being “homebound” is that “there must exist a normal inability to leave home AND leaving home must require a considerable and taxing effort.” Medicare allows infrequent non-medical trips outside the home for things such as attending an adult day care center, religious services and special occasions.

For example, a patient may be physically able to drive to do their household shopping but could be ill at ease due to a physical condition such as a colostomy or incontinence they fear might result in public embarrassment. Perhaps they’re a little feeble, frail and insecure on their feet, but otherwise mobile.

Even if they qualify for home health due to other factors, Medicare could deny or restrict that care based on finding the patient is not “homebound” under the program’s definition.

A major part of the 2017 revision is trying to answer the all-important question of what constitutes a “considerable and taxing effort.”

The care provider does not have to use the terms “taxing effort to leave the home” in the records, and using those qualifying phrases is insufficient “by themselves, to demonstrate that criterion two has been met.”

Short definition: Saying it doesn’t make it so. Provide evidence to prove it is.

Will Doctors Lie for Their Patients?

The question of whether or how often doctors will lie to benefit their patients is not a new one. The Journal of the American Medical Association (JAMA) Network published an article on this topic in October 1999. Dr. Daniel Sulmasy and Dr. Victor G. Freeman were two of the co-authors of the article “Lying for Patients: Physician Deception of Third-Party Payers.”

That research found that the more severe the condition requiring treatment, the more doctors were willing to “embellish” the diagnosis.

“Physicians were willing to use deception in the coronary bypass surgery (57.7%), arterial revascularization (56.2%), intravenous pain medication and nutrition (47.5%), screening mammography (34.8%), and emergent psychiatric referral (32.1%) vignettes,” the article’s synopsis points out. “There was little willingness to use deception for cosmetic rhinoplasty (2.5%).”

So, securing a life-saving surgery could convince the physician to “stretch the truth,” but ensuring the patient gets a nose job so they look more like Taylor Swift does not.

“Many physicians sanction the use of deception to secure third-party payers’ approval of medically indicated care,” the article noted. “Such deception may reflect a tension between the traditional ethic of patient advocacy and the new ethic of cost control that restricts patient and physician choice in the use of limited resources.”

The authors concede there is one possible drawback to their study.

“Although physicians indicated a significant willingness to sanction deception, we are unsure of the extent to which such willingness translates into the actual use of deception in practice,” they wrote. “Are physicians as willing to deceive in practice when faced with the possibility of civil or criminal sanctions? Conversely, does the frequent process of attempting to secure patient care and repeated frustration further embolden a physician?”

Translation: The “spirit is willing, but the flesh is weak.” However, these laws preventing this treatment are so frustrating that the “flesh” is getting stronger.

The doctors said they “believe our data indicate that physicians, at a minimum, accept and are willing to use deception as a means of responding to third-party payer restrictions.”

The authors also noted the sample size may be too small to provide a conclusive result. They sent surveys to over 450 randomly selected physicians in four geographic regions – two each in the East, Midwest, South and West. Only 169 (37.3 percent) responded.

Practitioner’s Priority: Patient or Procedure?

The “Lying for Patients” article found that 76.4 percent of the 169 physicians surveyed for the report “believed their primary professional responsibility was to practice as their ‘patient’s advocate– working within the rules and restrictions of third-party payers, so long as those rules do not significantly compromise my patient’s interests.’”

There were 4.3 percent of respondents who put “strict adherence” to the policies and procedures of third-party payers above the interests of their patients and 3.7 percent who did what was best for their patient “without regard to the rules/restrictions of third-party payers.”

Of those committed to “patient advocacy,” 63.2 percent would lie to ensure a coronary bypass was covered by the insurer, compared to only 29.2 percent of doctors who did not hold that philosophy. The differences were 62.1 percent to 25 percent for arterial revascularization and 53.7 to 23.1 for intravenous pain medication/nutrition.

The 1999 report cited an August 1988 study that found 70 percent of physicians in the Northeast “would knowingly mis-document a screening test as a diagnostic service to ensure coverage of service.” That article reported that a patient’s cost of care was considered an “ethical dilemma” in 11.1 percent of the cases reviewed.

The top two ethical issues were dealing with a patient with diminished cognitive abilities (71 percent) and who refuses recommended treatment (64 percent).

Truth AND Consequences

The researchers noted that modern medicine is no longer solely a doctor-patient relationship. Health insurers – whether Medicare, Medicaid or private companies – are full-fledged partners in that arrangement.

“Physicians and patients are contractually bound to third-party payers and their rules,” the article states. “On occasion, such obligations conflict with physicians’ obligations to act as patient advocates. Although using deception to solve these impasses may succeed in the interim, their long-term costs in loss of integrity and increased practice oversight are high.”

Sulmasy and Freeman called for “direct confrontation and frank dialogue between physicians, patients, and payers” to find a way to resolve issues that might force doctors to “embellish” their records so patients get the care they need but may not be able to afford otherwise.

“Refusal to initiate a social dialogue regarding the appropriate balance between medical and economic considerations places medicine at risk of becoming a practice of equal parts patient care and subterfuge,” they warned.

‘Robin Hood’ or ‘Pinocchio’

The two doctors spoke to Fox News in 2013 about solving the problems that lead some doctors to lie, or at least consider lying, to ensure their patients get the treatment they need.

“There are those who might think, ‘How horrible, these doctors are lying,’ and others may say, ‘How wonderful, the doctors are being advocates and Robin Hood and redistributing money,’” Sulmasy told Fox. “The real question is, ‘What’s wrong with our health care system that makes doctors think they need to lie to get patients services?”

Sulmasy said health care regulations require pre-authorization for tests and treatment to contain rising health care costs.

However, these procedures and protocols “really are blunt instruments and time-consuming and annoying for physicians, and those are what feed the temptation to change coding,” he added.

Freeman said the problem of lying for patients so uncovered treatments are covered is a reflection of the American “fee-for-service” business model.

“If you make more by doing more, you will do more,” Freeman told Fox. In response, state and federal governments and private health care insurance programs “pile on loads of red tape.”

Freeman says physicians are put in what he calls “the Pinocchio Dilemma. They are either ‘puppets,’ doing what payers require, or ‘liars,’ embellishing documentation to get around payer restrictions.”

Adding Stress to a Stressful Job

In addition to performing an already stressful job – where one mistake can have life-changing or even life-ending consequences -– health care professionals must also be aware of the rules and regulations affecting that job. It becomes a balancing act of being careful to comply with the laws while also taking care of their patients.

What do you do when your head says, “I can’t do that,” and your heart says, “I have to do something to help”? In this case, as in most, listening to your head is the best way to avoid trouble.

There are efforts by several organizations to improve the Medicare system to avoid problems, clarify confusing guidelines and serve the needs of the program’s beneficiaries. There are also those who see the program as a “government giveaway” that needs to be scaled back and reined in to save money.

Who will win?

You can read more of our recent coverage on Medicare Fraud here, here and here.

For more in-depth articles, features and analyses, be a frequent visitor – or newsletter subscriber – to The Daily Muck.

Discover More Muck

First AI-Powered Lawsuit Exposes California’s Eco-Fraud Empire

Feature John Lynn | Apr 10, 2025

Weekly Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.

Weekly

Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.