Man Purchased Millions in Real Estate, Took Advantage of Programs Meant to Help Homeowners

The verdict came after a 12-day trial. Tarshish faces 30 years in prison.

An Industry Created to Game the System

Tarshish was an employee of My Ideal Property (MIP), Inc. and an owner of Exclusive Homes Realty Group, Inc., Exclusive Homes NY, LLC and Homeowners Solutions Group LTD. However, these aren’t the only companies involved in the scam, and Tarshish didn’t work alone. His story goes back to 2012 and starts with Iskyo “Isaac” Aronov, one of the co-conspirators.

MIP was formed in early December of 2012 by Aronov, according to an indictment obtained by The Daily Muck. The company styled itself “as a real estate development company… focused on rehabilitating distressed properties.” MIP boasted a portfolio of related work projects and professionals: mortgage bankers, inspectors, engineers, attorneys, insurance representatives, “short sale processors and other professionals who were involved in the process of buying and selling property.”

Michael Konstantinovskiy, another co-conspirator, formed National Homeowners Assistance, Inc. (NHA) and Settle NY Corp., which purported to be short-sale processing companies that claimed to help distressed homeowners negotiate with lenders.

Tarshish established Exclusive Homes NY, LLC, and Exclusive Homes Realty Group, Inc., Brooklyn-based companies focused on real estate investment. Tarshish also founded Homeowners Solutions, a Brooklyn-based company allegedly representing homeowners looking to sell their properties through short sales.

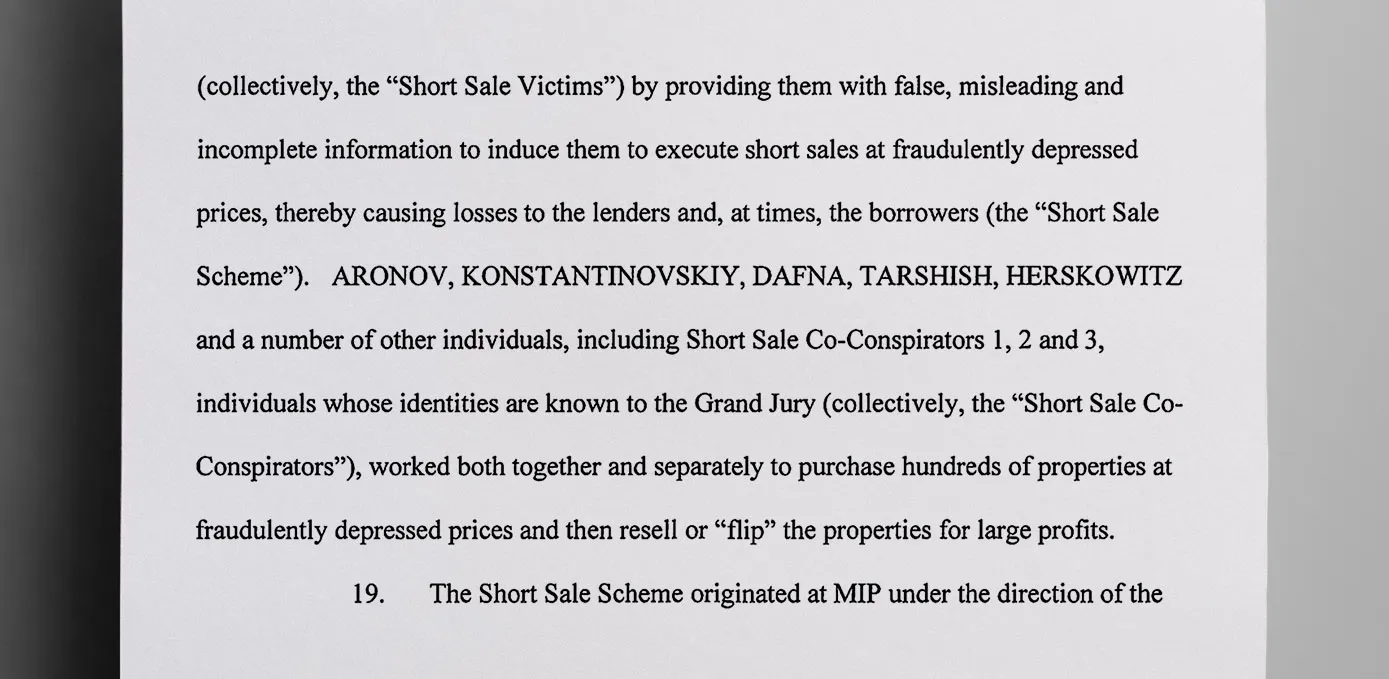

Trial evidence and testimony showed that between 2012 and 2019, the fraudsters misled mortgage lenders into “approving short sale transactions at fraudulently depressed prices.”

They did this by providing lenders with false or misleading derogatory information. This encouraged lenders to execute short sales at low prices, ultimately leading to capital losses on behalf of both lenders and borrowers. Tarshish and his co-conspirators then purchased these properties in the short sales, reselling them for higher prices.

After the success of this scam at MIP, Tarshish and the others emulated the business model at Exclusive Homes. Michael Herskowitz, a real estate attorney, assisted the “Short-Sale Co-Conspirators” in carrying out fraudulent short sale deals tied to MIP and Exclusive Homes.

Cheated Government Mortgage Programs

Tarshish and others primarily targeted borrowers in Queens and Brooklyn who had defaulted on their mortgages and were in foreclosure proceedings. During a short sale, the mortgage loan borrower sells the real property for less than the outstanding balance of the original mortgage with the approval of the mortgage company. The sale proceeds, minus closing costs, are used to pay off a portion of the remaining loan, and the lender typically agrees to forgive the rest of the loan. The homeowner can walk away without owing further debt or fear of being sued by their lender.

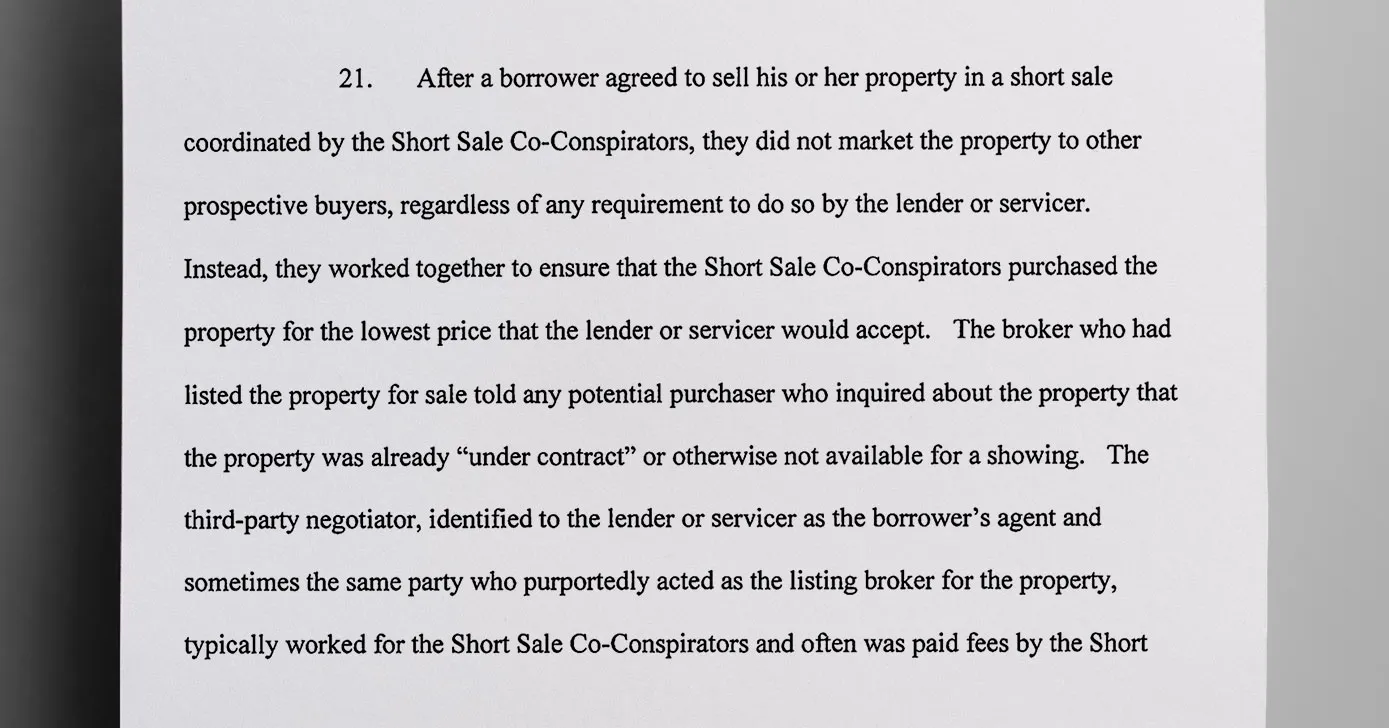

Tarshish and his co-conspirators would pay the owners to agree to short sales but then sabotage the process to keep potential buyers from making higher offers. This included skipping steps like marketing the properties properly, as required by lenders, filing false liens, and even trashing the homes by removing plumbing and causing damage they referred to as making the homes “pretty.” On top of that, they misled lenders by lying on paperwork, hiding payments made to homeowners and failing to disclose side deals to sell the properties for higher prices later.

Many loans were linked to government-backed programs such as FHA, Fannie Mae and Freddie Mac. Under the Pre-Foreclosure Sale (PFS) Program, the U.S. Department of Housing and Urban Development allows short sales for properties with FHA-insured loans—but with strict rules. According to the guidelines, neither the buyer nor the seller can collect funds or commissions from the sale.

Dozens of Fraudulent Deals

At trial, prosecutors laid out evidence showing the scheme ran for years and involved dozens of fraudulent deals. They highlighted 11 Brooklyn properties where the group’s tactics cheated lenders out of more than $2.4 million, according to court documents.

An example of one of their schemes was at 175 Vernon Avenue in Brooklyn.

Aronov and Konstantinovskiy orchestrated the short sale of 175 Vernon Avenue, purchasing it for $222,200 in December 2013 after paying the seller $10,000 through a company controlled by Aronov. Fannie Mae held the mortgage at the time.

The sale was approved based on documents with false claims, including that no undisclosed payments or agreements existed when, in fact, payments to the seller and co-conspirators were hidden from the servicer. Relying on these misrepresentations, Fannie Mae filed an FHA insurance claim, leading HUD to pay Fannie Mae $697,226 for the outstanding mortgage balance in early 2014.

Less than five months later, Aronov resold the property for $965,000, closing the sale in August 2014 and profiting significantly from the scheme.

Tarshish and Others Preyed on Vulnerable Sellers.

Breon Peace, U.S. Attorney for the Eastern District of New York, noted that Tarshish’s actions harmed government mortgage agencies and programs. “The defendant defrauded taxpayer-funded mortgage loan holders out of millions of dollars and took advantage of programs designed to help distressed property owners in need,” said Peace.

“Short sale mortgage fraud not only harms lending intuitions, it also depresses real estate values throughout our neighborhoods and prevents community members from gaining fair access to housing.”

Vicky Vazquez, a special agent-in-charge with HUD, said that Tarshish and his co-conspirators concocted a $2.4 million scheme “to cause FHA-insured mortgage lenders to approve short sale transactions at fraudulently depressed prices by misrepresenting material information for his own enrichment.”

In manipulating the mortgage loan system, Tarshish and his co-conspirators “preyed” on people facing foreclosure, which resulted in millions in losses to their victims, according to the Justice Department’s press release.

Discover More Muck

First AI-Powered Lawsuit Exposes California’s Eco-Fraud Empire

Feature John Lynn | Apr 10, 2025

Former Child Soldier General Lied to Get Green Card

Report Strahinja Nikolić | Feb 27, 2025

Weekly Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.

Weekly

Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.