Teresa Tennyson

Jun 21, 2024

From unnecessary heart surgeries to stolen medical information, the range of medical fraud is extensive. It costs Americans more than $100 billion per year, harming all of us through higher taxes and premiums, reduced services, and may even damage our health and could cost us our lives.

Medical fraud comes in many forms– from large schemes targeting taxpayer-funded medical infrastructure to personalized financial attacks on individuals. It also encompasses medically unnecessary prescriptions and pharmaceutical fraud. Not taking medical fraud seriously can put you at risk.

Here’s what you need to know to protect yourself and others.

Why Healthcare Fraud Matters to You

It’s easy to think of healthcare fraud as something that doesn’t affect you directly, a crime against a faceless bureaucracy.

But in one way or another, it does affect us, at the very least, financially. At the very worst, it can compromise our health.

Higher Insurance Premiums

All costs drive up insurance premiums, but fraud is especially problematic, contributing to a toll of billions on public and private healthcare insurance.

Insurance fraud is one reason premiums are so high. The average unsubsidized monthly health insurance premium in 2023 was $702 for individual coverage and $1977 for family coverage, according to data gathered by the Kaiser Family Foundation (KFF), a research firm.

Higher Taxes

While fraud against private companies results in higher premiums, fraud against public entities like Medicare and Medicaid results in higher taxes for everyone, including those who don’t use public healthcare.

Unnecessary Medical Procedures

Healthcare fraud can also result in unnecessary medical procedures.

Unnecessary medical procedures hurt patients in two ways. First, any medical procedure entails some element of risk. Second, patients can be hit with copays from procedures– including surgeries– that they don’t really need.

Types of Healthcare Fraud

Healthcare fraud can refer to a diverse number of distinct frauds– from crimes targeting government healthcare networks to pill mills that put the public at risk through illegal prescription drug distribution.

Medical fraudsters also steal from relief funds and expose patients to medically unnecessary procedures.

The elderly and military veterans are especially at risk, but anyone can be a target.

Fraud Targeting Relief Programs

The newest form of healthcare fraud sprang up in the wake of the COVID-19 pandemic.

As soon as the government enacted legislation to protect individuals and companies from the pandemic-caused economic slowdown, scammers started targeting those funds by filing fake claims, reducing the availability of funds for those who needed them and costing taxpayers billions.

The U.S. Government Accountability Office (GAO) estimated that fraud against COVID-19 relief programs cost taxpayers between $100 and $135 billion dollars, according to an analysis published in September 2023. That’s an estimated 11 to 15% of all money paid in COVID-related unemployment relief programs.

Fraud against taxpayer-funded medical relief programs also steals resources from those who need them.

Paycheck Protection Program Fraud

The good news is that the government is serious about cracking down on the individuals and companies that file false claims from the Paycheck Protection Program (PPP) and other COVID-19 relief programs. Prosecutions against these criminals are ongoing and will continue into the foreseeable future.

Some of the worst offenders of the relief programs are current and former government employees. In June 2024, a federal jury sentenced former Atlanta police officer Shelitha Robertson to seven years and three months in prison for her role in conspiring to defraud the PPP of more than $15 million, according to a Department of Justice (DOJ) press release dated June 7.

Robertson’s co-conspirator Chandra Norton was also convicted of charges related to the fraud.

As of March 2024, the Internal Revenue Service had investigated 1,644 cases of money laundering related to COVID-19 relief fraud, resulting in 795 criminal indictments as of that date, according to an IRS press release.

The rate of convictions in these cases has been high– around 98.5%.

COVID-Enabled Prescription Fraud

Scammers didn’t only target relief programs. They also exploited the circumstances of the pandemic to perpetrate a host of other healthcare frauds.

During the pandemic, the government relaxed restrictions on telemedicine to make sure that people had access to needed drugs when they were unable to visit medical providers in person. Some of the innovations of telemedicine have persisted even after the pandemic, improving access to medical care and reducing costs.

However, an unintended consequence of the rise of telemedicine was that it also facilitated prescription fraud by unscrupulous entities who used telemedicine to their advantage.

In June 2024, a federal grand jury indicted Ruthia He, founder and CEO of Done Global Inc., for what they say amounts to a scheme to subvert relaxed rules surrounding telemedicine in the wake of the pandemic, according to a DOJ press release dated June 13.

Prosecutors allege that He’s company illegally prescribed Adderall and other illegal stimulants to consumers who didn’t need them.

Medically unnecessary prescriptions like Adderall can harm patients, leading to addiction and other long-term effects, according to American Addiction Centers, which operates a network of rehab facilities.

Additionally, prescriptions for Adderall and other medications for people who don’t need them can contribute to severe shortages for people who do. In the case of Adderall, the U.S. has suffered shortages since at least October 2022, according to a Food and Drug Administration (FDA) information page.

Finally, COVID-enabled prescription fraud puts patients at risk for medical identity theft, according to a warning by the Department of Health and Human Services (HHS).

Scammers often sell medical records and other health information, exposing victims to further medical and identity fraud, according to Aura, an identity, privacy, and security company.

Other Pharmaceutical Fraud

Aside from the circumstances surrounding the COVID-19 pandemic, pharmaceutical fraud is an ongoing problem in its own right. These frauds have been around for years, with unscrupulous networks often recruiting physicians and other medical providers to facilitate these frauds.

Fraud networks use providers to write prescriptions for medication or other treatments, such as back braces. In many cases, these treatments are medically unnecessary, putting patients and risk and bogging down the healthcare system. In some cases, the patients don’t receive any treatment, but fraudsters bill insurers for them anyway.

Some physicians who have been lured by these companies may have thought they were providing a legitimate, ethical service. For its part, the government goes to great lengths to raise awareness of the issue.

“As a physician, you are an attractive target for kickback schemes because you can be a source of referrals for fellow physicians or other health care providers and suppliers,” reads a warning on the HHS website. “You decide what drugs your patients use, which specialists they see, and what health care services and supplies they receive.”

Pharmaceutical fraud may include the prescription of drugs that aren’t needed, including marketing drugs for off-label or unapproved use. Fraudsters often incentivize providers by reimbursing them with kickbacks and expensive trips, which are also illegal.

A range of laws– including the False Claims Act, the Anti-Kickback Statute, the Physician Self-Referral Law, and the Exclusion Statute– levy criminal and civil penalties against providers who engage in or facilitate medical fraud.

Medicare Fraud

Out of the estimated $100 billion in annual healthcare fraud in the U.S., Medicare fraud accounts for around $60 billion.

Unfortunately, victims unwittingly enable much of that fraud by providing Medicare numbers and other personally identifiable information (PII) to scammers, who may appear to be offering legitimate medical services.

Medicare is an attractive target for scammers because it is one of the largest health insurance programs in the world, according to the National Bureau of Economic Research (NBER).

Veteran Fraud

As with Medicare recipients, fraudsters often target veterans for fraud since they are eligible for a host of educational, financial, and health benefits, according to information published by the Veterans Benefits Administration (VBA). Health benefits include VA health care and disability pay.

One of the more common types of potential fraud involves entities offering to file for benefits on behalf of veterans, often luring them with the promise of large retroactive payouts. They may encourage veterans to file false claims or to exaggerate their symptoms. These companies offer to represent the veteran to the VBA, often in exchange for a significant portion of disability benefits awarded.

They might even be legitimate entities– some are even law firms– but they often use high-pressure sales tactics to encourage vets to sign up for their services, using some variation of “you must act now to secure your well-deserved benefits.”

But veterans don’t need these services to file disability claims, something that these services are not always upfront about. Veterans can get free help from a Veteran Service Organization (VSO). These VSOs work for nonprofits like the Veterans of Foreign Wars (VFW), Disabled American Veterans (DAV), and the Wounded Warrior Project.

The Department of Veterans Affairs (VA) even accredits VSOs, who can provide free advice and even file claims on behalf of the veterans they serve. Using a VA-accredited VSO can help veterans avoid fraud and unscrupulous claims services providers.

You can read more about fraudsters targeting veterans here.

Ransomware

Ransomware attacks may also enable healthcare fraud. In a ransomware attack, a malicious actor hacks into a network– usually a hospital, insurer, or other large medical provider. The scammers then hold the information systems hostage until the victim pays a “ransom” to regain access to their systems and data.

Even if the victim refuses to pay the scammer directly, they still will likely have to pay for expensive remediation to protect their patient data and, in some cases, reimburse patients for stolen identities.

In 2023, there were at least 460 ransomware attacks against medical entities in the U.S., according to HHS.

As with other forms of healthcare fraud, ransomware attacks don’t only affect bureaucrats and large companies. They directly affect consumers by driving up costs and compromising care. They also put patient data at risk for further exploitation, including identity theft.

In June 2024, the UK’s National Health Service (NHS) suffered a cyberattack that rendered its systems unable to process blood type matching, according to reporting by The Guardian. The situation became so dire that routine medical procedures had to be canceled, and hospitals had to solicit their own employees for emergency Type O blood donations.

Misrepresentation

In some cases, a medical fraudster may get treatment for themselves using someone else’s medical insurance. In other words, they steal your identity to get medical treatment covered for themselves.

This may seem innocuous but can hurt you in the long run by exhausting your benefits or contaminating your medical records with incorrect information. In case of the latter, it could compromise your care and potentially endanger your health or your life.

The Extent of Healthcare Fraud

Medical fraud is at an all-time high and steadily increasing. In 2023, the United States Sentencing Commission (USSC) released a fact sheet noting that the number of healthcare fraud cases increased 1.4% between 2018 and 2022.

Medical fraud incurs significant criminal, civil, and administrative penalties. Despite the threat of punishment, scammers are targeting healthcare at unprecedented rates.

The Toll of Healthcare Fraud

The GAO estimates that fraud consumes about 10% of total healthcare spending, exceeding more than $100 billion per year.

What if that money wasn’t stolen? What if it could somehow be put back into the system? How much healthcare could $100 billion buy?

For one thing, it could pay off Americans’ collective medical debt in less than two years. As of 2021, the total medical debt in the United States owed by individual Americans was at least $140 billion, according to a retroactive study published in the Journal of the American Medical Association.

So if we could eliminate fraud, would we have enough resources to also virtually eliminate medical debt?

It seems possible, at least theoretically. But while fraud persists and continues to drive up healthcare costs, we can’t know for certain.

However, significantly reducing fraud would undoubtedly be a step in the right direction, potentially providing economic relief to millions of Americans.

What Healthcare Fraud Looks Like

Healthcare fraud comes in many forms, often masquerading as a solicitation for legitimate benefits or treatment. Fraudsters most commonly use telemarketing schemes– cold-calling– to initiate these scams. Recently, scammers have also begun using email and even text messages to reach out to potential victims (patients) and enablers (medical providers).

Telemarketing Scams Targeting Patients

Be suspicious of any attempt to prescribe you a medical treatment that does not go through your regular medical providers or their expert referral process.

These telemarketers might promise you free services– such as a back brace or orthotics– and they may even convince you that you need these items and promise to get them on your behalf at no or very low costs. They might even ask for access to your medical records so a provider can provide a virtual examination.

At first, it might seem like a good deal. After all, they aren’t asking for any financial information or payment, only your insurance or Medicare number. And isn’t that what medical insurance is for?

In these situations, you probably don’t need what these fraudsters are promising. And you might not ever even receive the treatment that they are offering. Scammers are trying to gain access to your medical information, which they might use to bill Medicare or your insurance provider for services that are not needed and/or never delivered.

Telemarketing Scams Targeting Providers

Patients aren’t the only victims of unscrupulous fraudsters– medical providers may unwittingly be as well.

Since July 2022, the Department of Health and Human Services (HHS) has had a Special Fraud Alert in effect directed at raising awareness of telemedicine schemes among medical providers.

The alert notes that unethical telemedicine companies are recruiting providers to prescribe treatments without talking to patients in exchange for payments that federal law might consider kickbacks. The alert also provides information on what these fraudulent telemedicine schemes look like, so providers can better identify them.

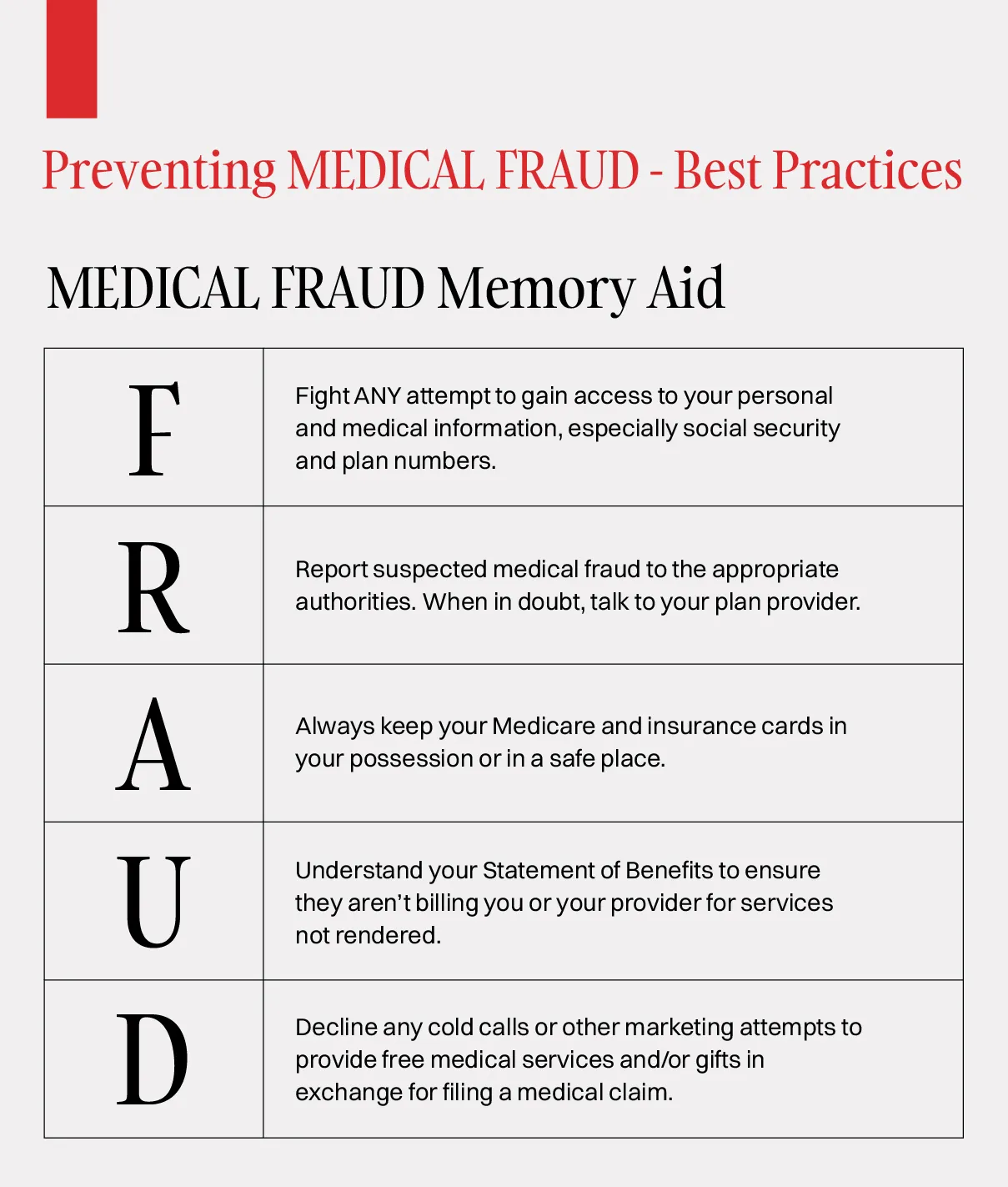

How to Stop Healthcare Fraud

While would-be fraudsters will always exist, being vigilant will help deter medical fraud targeting you individually and the healthcare system at large.

Protect Your PII

Regardless of the form of healthcare fraud, the best weapon in your arsenal is protecting your personal identifying information (PII). This includes your medical records and your social security and healthcare plan numbers. Dates of birth, phone numbers, and address information should also be shielded, even if some of that information is publicly available.

If someone contacts you unexpectedly asking for any medical information and promising you something free in return, it’s a scam. You should not give out any information to these fraudsters, especially not medical plans and social security numbers.

If you do find out your health insurance number has been compromised, you can call your insurance provider to ask them to issue you a new one. The insurer might also enable identity monitoring on your account to prevent further fraud attempts using your plan or medical information.

Considerations for Medicare Beneficiaries

The Centers for Medicare and Medicaid Services (CMS), a government organization, recommends that patients never give out their Medicare information, including their beneficiary number, to anyone who solicits that information via phone call, text, or email.

Here are more tips to prevent your Medicare information from falling into the wrong hands, as recommended by Medicare:

- Don’t give out your Medicare and Social Security numbers except as needed by your provider

- Keep your Medicare card safe in your control at all times as if it were a credit card

- Make sure you check the statements from your provider and Medicare to ensure they are accurate and report any discrepancies

- Medicare will never call or visit your home to sell you stuff– do not provide your personal information to anyone representing themselves as Medicare under these circumstances.

- Don’t accept money or gifts in exchange for medical services or provide your Medicare information

- Don’t allow anyone except your doctor and Medicare provider to review your medical records

Also, be aware that Medicare Advantage– such as Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) plans– are supposed to follow certain rules.

For instance, by law, they aren’t allowed to do the following:

- Solicit you where you receive medical care, like at your doctor’s office or at a pharmacy.

- Request payment over the phone or online without sending a bill.

- Come to your home uninvited to sell you a plan

- Offer you cash, gifts worth more than $15, or free meals to attend sales pitches

For a complete list of what Medicare supplemental plan agents should not do, you can check out all the rules here.

If a Medicare Advantage or other plan provider violates these rules, avoid dealing with them. Using scrupulous providers incurs much less risk that you will fall victim to fraud or have to deal with the aftereffects of it, such as identity theft.

Patients should also be aware that medical fraudsters go to great lengths to look like legitimate providers.

When in doubt, call 1-800-MEDICARE with any questions about Medicare and Medicare Advantage providers.

Screen Medical Providers

Patients should always exercise due diligence when selecting a new medical provider, even one that has been recommended by a friend or family member.

Physicians with good reputations not only provide better care but also should be less inclined to be involved in medical fraud.

You can start by looking at the ratings that former patients have given them. Plenty of sites facilitate this, including HealthGrades.com, RateMDs.com, and Vitals.com.

Patient ratings admittedly tell only part of the story, but they are useful. Look for commonalities among ratings that might indicate positive and negative trends related to care.

For current professional information, you also can check out doctors at docinfo.org. This site, run by the Federation of State Medical Boards, enables you to find out if your doctor is licensed, their professional background and certifications, and any state medical board actions against them.

When in Doubt, Get a Second Opinion

If you have a doubt as to whether a treatment is medically necessary, consider getting a second opinion. Medical treatment includes orthotics, braces, medications, and even surgeries.

In 2015, a federal jury convicted Dr. Harold Persaud, an Ohio cardiologist, of performing medically unnecessary procedures, including coronary bypass surgeries, and subsequently bilking Medicare and other insurers of at least $7.2 million, according to a press release by the U.S. Attorney’s Office, Northern District of Ohio.

If something doesn’t make sense to you, make sure you ask questions. If something still doesn’t sit right with you, seek a second opinion. An honest medical provider will understand your right to seek a second opinion and should even support it.

End Using DOBs as “Unique Identifiers”

As medical and pharmacy records across states become increasingly interlinked, the old ways of verifying customers have become increasingly outdated.

It used to be enough to verify someone’s name and date of birth (DOB). Unfortunately, many people share the same names and dates of birth and, given the large repositories of data, medical workers can inadvertently pull up the wrong person.

This type of fraud might not be “intentional,” but it does come from people not verifying information, including the social security number of the patient. It’s easy to assume you’ve found the right person when the name and date of birth match.

And it can result in unintended charges and a hassle when you go to the pharmacy, which has happened to several people who were using different branches of the same large pharmacy chain, according to this Reddit thread.

As these situations show, DOBs should only be used as a unique identifier in combination with other information, such as a phone number or address.

Providers are mainly responsible for diligently verifying patient information, but patients can also play a role by requesting, for instance, that providers only dispense care upon verification of other information, such as a middle name or the last four digits of a phone number.

Pharmacies can then enter this request into their database under a customer’s record, which could stop patients from intentionally or accidentally receiving care under another person’s insurance.

Government Enforcement Actions

Fraudsters might find healthcare funds lucrative, but the amount of healthcare fraud incentivizes the government to allocate significant resources to fighting it.

The Criminal Division of the Justice Department has a dedicated Health Care Fraud Unit that includes 80 experienced prosecutors.

Additionally, the FBI, HHS, NIH, CMS, and a host of other state and federal entities dedicate plenty of resources to fighting these crimes.

Witnesses to healthcare fraud, therefore, have plenty of options when it comes to reporting.

WHERE TO REPORT SUSPECTED HEALTHCARE FRAUD

Fraud Against Veterans: For healthcare-related fraud, contact the Veterans Health Administration, Office of Integrity and Compliance Helpline at 1-866-842-4357 (VHA-HELP).

For suspected VA Benefits fraud, call the VA Benefits Hotline at 1-800-827-1000.

Fraud Against Senior Citizens: Report any suspected fraud targeting the elderly to the U.S. Department of Justice’s National Elder Fraud Hotline at 1-833-372-8311.

Fraud, Waste, Abuse, and Mismanagement: Report these types of suspected fraud directly to the Department of Health and Human Services (HHS) online at oig.hhs.gov/fraud/report-fraud/ or call 1-800-HHS-TIPS.

Fraud Against Health Insurers and/or Organized Criminal Networks: Make an online complaint to the FBI at tips.fbi.gov/ or call the tip hotline at 800-CALL-FBI

Pharmacy and Drug Fraud: The Drug Enforcement Administration (DEA) investigates pharmacological fraud. Make an online complaint at www.dea.gov/submit-tip.

To report illegal prescription drug sales or suspicious pharmacies, make an online complaint at apps.deadiversion.usdoj.gov/rxaor/spring/main?execution=e1s1

Or call the DEA tip hotline for either situation at 1-877-792-2873.

Direct Report to DOJ: To submit a digital tip directly to the Justice Department, you can send an email to HCF.tips@usdoj.gov.

If you don’t feel comfortable using email, you can also report healthcare fraud of any kind via postal mail to this address:

Fraud Section, Criminal Division

U.S. Department of Justice

ATTN: Chief, Health Care Fraud Unit

950 Constitution Ave., NW

Washington, DC 20530

Why Reporting Medical Fraud is Key

If you suspect medical fraud, the number one thing you can do to protect yourself and the medical system is to report it. In most cases this can be done anonymously if you are uncomfortable about providing the information under your own name.

Rewards for Reporting Medicare Fraud

If you know about a case of Medicare fraud, you may even receive a reward for reporting it. This is most applicable to cases of widespread or systematic fraud, and you need to obtain an attorney to do it.

Rewards can be a percentage of the money the government is able to recover from fraudsters, according to an information page on the American Association for Medicare Supplement Insurance website. The organization reports that rewards can vary between 15 and 25 percent of what the government is able to collect from fraudsters, potentially putting millions in a whistleblower’s pocket.

If you believe this situation might be applicable to you, you can find a lawyer to represent you specializing in this type of action through a simple Internet search.

You can check out The Daily Muck’s other coverage of healthcare fraud here.

Reprint and Permissions

Email

info@dailymuck.com

The Daily Muck grants permission to other publications and individuals to use our articles, images, and content,

provided that proper credit is given by linking back to the original source at https://dailymuck.com.

To request additional permissions or for any inquiries, please contact us at info@dailymuck.com.