“Pump-and-Dumper” Pleads Guilty in International Stock Conspiracy

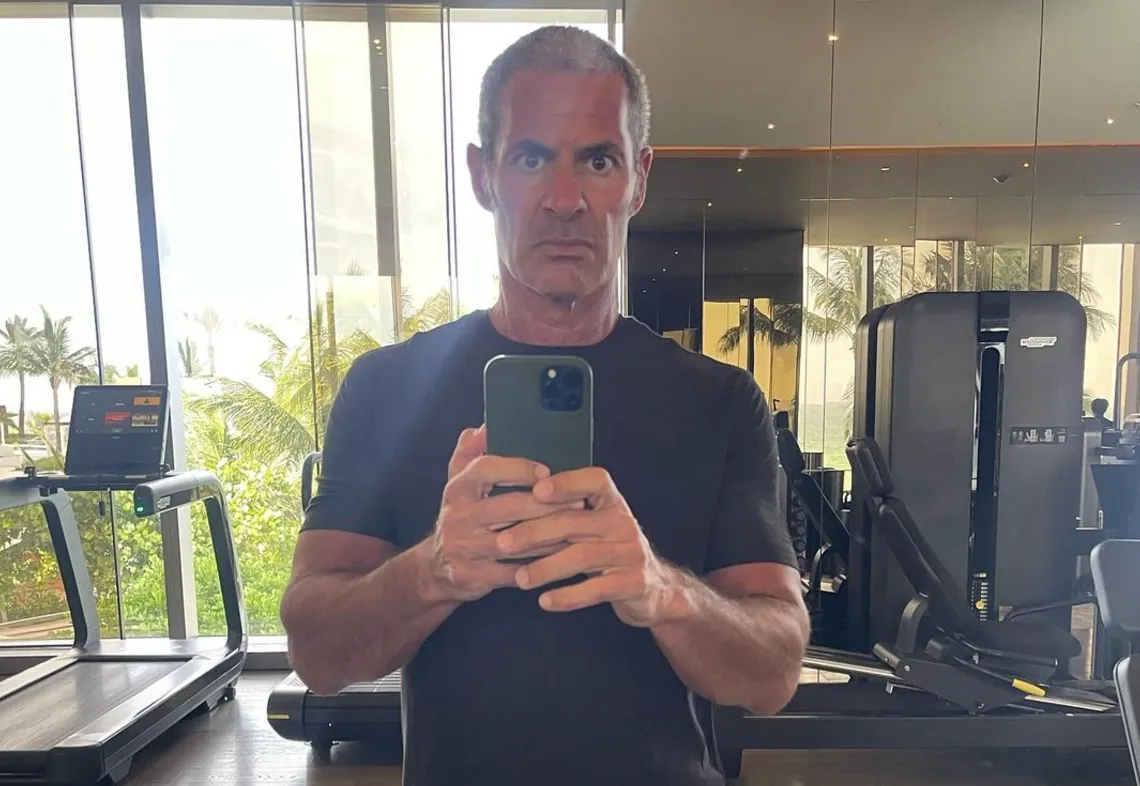

Ronald Bauer, a Canadian/British venture capitalist, has pleaded guilty in a U.S. federal court to a stock manipulation scheme. Photo credit: Instagram/ronbauer888

Bauer and his coconspirators participated in a conspiracy to commit securities fraud on seven different stocks: Cantabio Pharmaceuticals (previously Lion Consulting Group), Virtus Oil and Gas (previously Curry Gold), Steampunk Wizards (previously Freedom Petroleum), Black Stallion Oil and Gas (previously Secure IT), PetroTerra (previously Loran Connection), Black River Petroleum (previously American Copper) and Cyberfort Software (previously Patriot Berry Farm), according to a DOJ press release.

Not the First Time

Bauer was allegedly a mastermind behind previous pump-and-dump schemes, and his first fraud claims against him were filed in 2005 for a market manipulation scheme, according to the Securities and Exchange Commission (SEC).

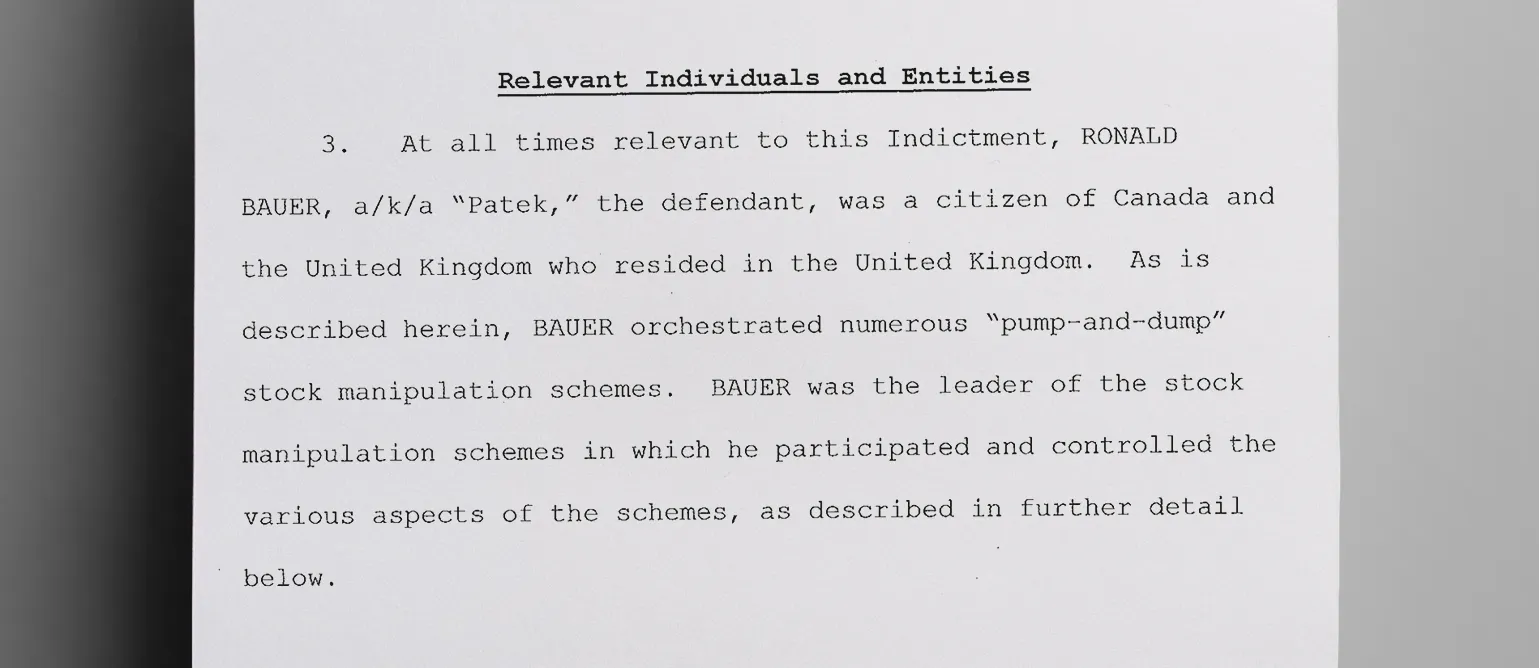

In the current case, Bauer, who also goes by the nickname “Patek,” was charged back in 2022 as one of the ringleaders of a ten-men group whose members were scattered all around the world – from Canada, Bahamas, to Bulgaria, Spain, Monaco, and Turkey, according to a previous DOJ statement.

Authorities say Bauer uses misleading and manipulative tactics like issuing false press releases while secretly dumping millions of shares into the inflated market he and his associates created, according to an indictment obtained by The Daily Muck. Bauer’s latest round of manipulation started in 2013 and lasted until at least 2019.

Prosecutors say the 10 charged defendants, including Bauer, harvested more than $100 million in the pump-and-dump scheme, meaning investors lost at least that much.

While he awaits sentencing, Bauer is allowed limited travel to Canada to visit his father’s burial site and Italy for the limited purpose of securing or protecting against the involuntary dissipation of real property that may be used to satisfy any forfeiture order or any future civil fines or penalties that Mr. Bauer may incur, according to a court memorandum obtained by The Daily Muck.

Reactions by Officials

In achieving the guilty plea, U. S. Attorney Damian Williams said his office was “committed to holding market manipulators accountable no matter how hard they try to conceal their crimes.”

“For years, Ronald Bauer orchestrated a sprawling ‘pump-and-dump’ scheme involving the shares of numerous U.S.-based issuers that preyed on ordinary, retail investors,” Williams said.

“While Bauer and his co-conspirators lived outside of the United States, they took advantage of the U.S. markets to perpetrate their fraud and reaped millions upon millions in profits at the expense of the victims,” Williams added.

Hopefully, this conviction will permanently disable Bauer’s ability to harm small investors through stock manipulation schemes.

“Stock manipulation schemes such as the one charged here today serve to undermine confidence in our financial markets and create a playing field designed to illegally benefit a greedy few fraudsters at the expense of many honest investors,” said FBI Assistant Director Michael J. Driscoll in a statement.

What Are Pump-and-Dump Schemes?

Pump-and-dump schemes occur when fraudsters, some of which are high-profile investors, spread false information to increase a stock’s value. When investors act upon this information to buy these assets, the price increases and the scammers sell their own stock, “dumping” it back on the market at relatively high prices. But the glut of stock on the market increases supply, forcing the market price lower. Retail or “regular” investors often lose significant investments in these frauds.

Pump-and-dump scams typically use stocks of small companies about which there is limited information, according to the SEC. Most of these trades occur “over the counter” and are not traded on public platforms like the Nasdaq and New York Stock Exchange.

Discover More Muck

First AI-Powered Lawsuit Exposes California’s Eco-Fraud Empire

Feature John Lynn | Apr 10, 2025

Former Child Soldier General Lied to Get Green Card

Report Strahinja Nikolić | Feb 27, 2025

Weekly Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.

Weekly

Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.