Florida Man Indicted For Allegedly Running Fake Tax Shelter

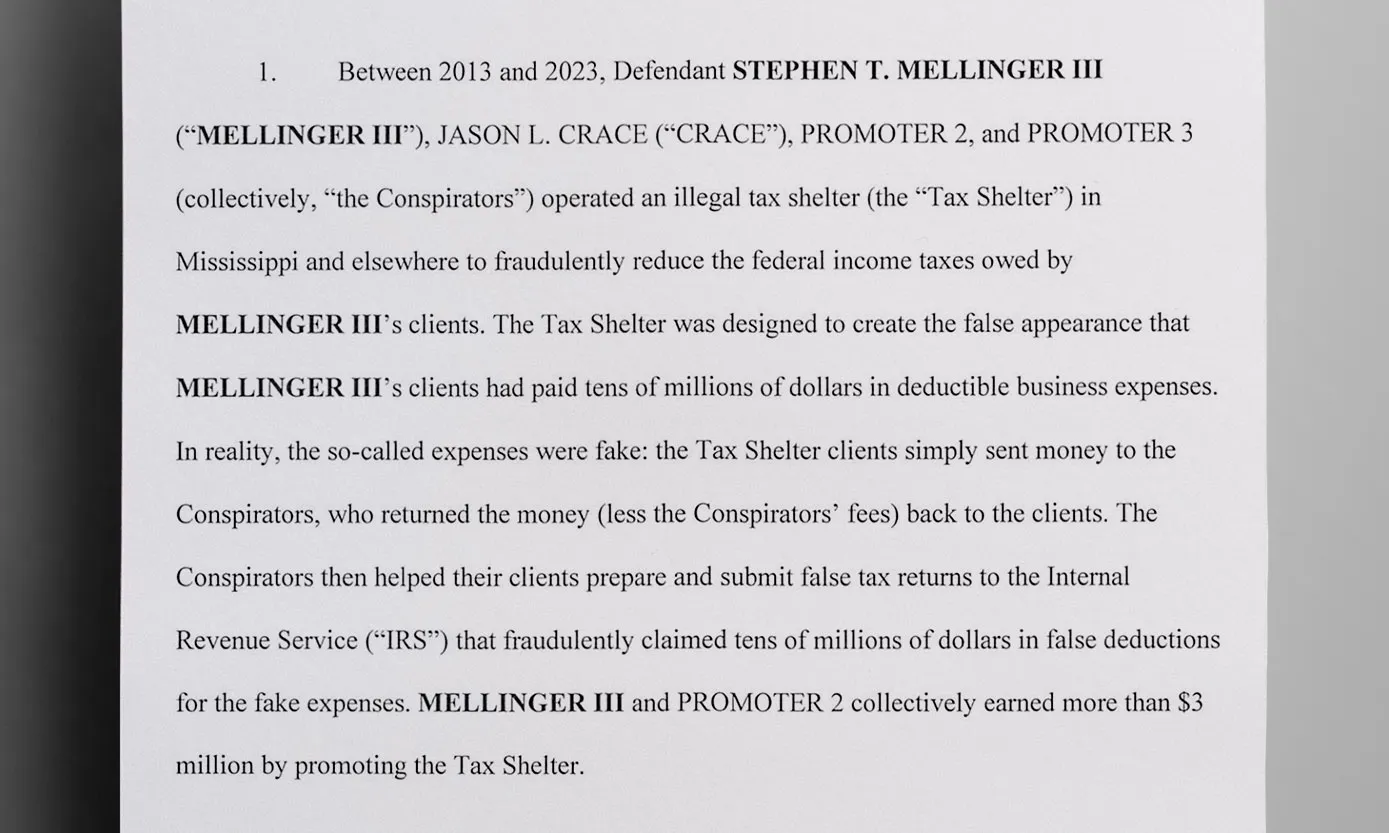

From late 2013 until 2023, Mellinger operated an illegal tax shelter scheme, earning more than $3 million in fees, according to an indictment obtained by The Daily Muck.

Scamming Other Scammers

In one case, Mellinger stole money from clients who had themselves defrauded the U.S. government, feds say. This group of clients allegedly stole money from TRICARE and other health benefit programs. TRICARE manages health care for U.S. military members and veterans.

Prosecutors say Mellinger hid money from these transactions on behalf of his clients, but he ended up conspiring with a relative to steal and launder it for himself.

He allegedly used part of these funds to buy a house located in Delray Beach, Fla, according to the press release.

The Scheme

Prosecutors say Mellinger instructed clients who participated in his illegal tax shelter to transfer money to a company operated by him or some of his co-conspirators, claiming that the amount they wanted transferred was a deduction on their tax returns.

After this, Mellinger and his cohorts returned the money to his clients’ bank accounts, but allegedly without the percentage fee that they charged for their services.

Even though tax shelter clients received their money back, Mellinger allegedly directed them to claim the transfer to the company as a deduction on their tax returns and label it as a “royalty” payment.”

Mellinger earned more than $3 million in fees from the shelter, according to the indictment.

Current Charges

Feds charged Mellinger with conspiracy to defraud the United States, aiding in preparing false tax returns, conspiracy to commit wire fraud, conspiracy to commit money laundering and money laundering.

If convicted, Mellinger faces decades behind bars.

Mellinger’s Troubled History

This isn’t the first time Mellinger has allegedly run afoul of the law, according to his SEC broker report. The report included previous complaints of damaging clients financially while working as an adviser for NYLIFE Securities, LLC.

Some of those complaints alleged Mellinger gave inappropriate tax shelter advice.

What are tax shelters?

A tax shelter is a strategy that reduces tax liability.

But to do that, the tax shelter must be legal. Examples of tax shelters include retirement and education accounts, health savings accounts and even municipal bonds. The federal government gives Americans a tax break to encourage them to invest in these devices.

Illegal or “abusive” tax shelters include some conservation easement schemes and hiding money in foreign accounts to hide tax liabilities. Taxpayers who claim these deductions risk high fines and even jail.

You can see a list of the IRS’s “Dirty Dozen” illegal tax schemes here.

Discover More Muck

First AI-Powered Lawsuit Exposes California’s Eco-Fraud Empire

Feature John Lynn | Apr 10, 2025

Former Child Soldier General Lied to Get Green Card

Report Strahinja Nikolić | Feb 27, 2025

Weekly Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.

Weekly

Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.