Raymond L. Daye

Dec 2, 2024

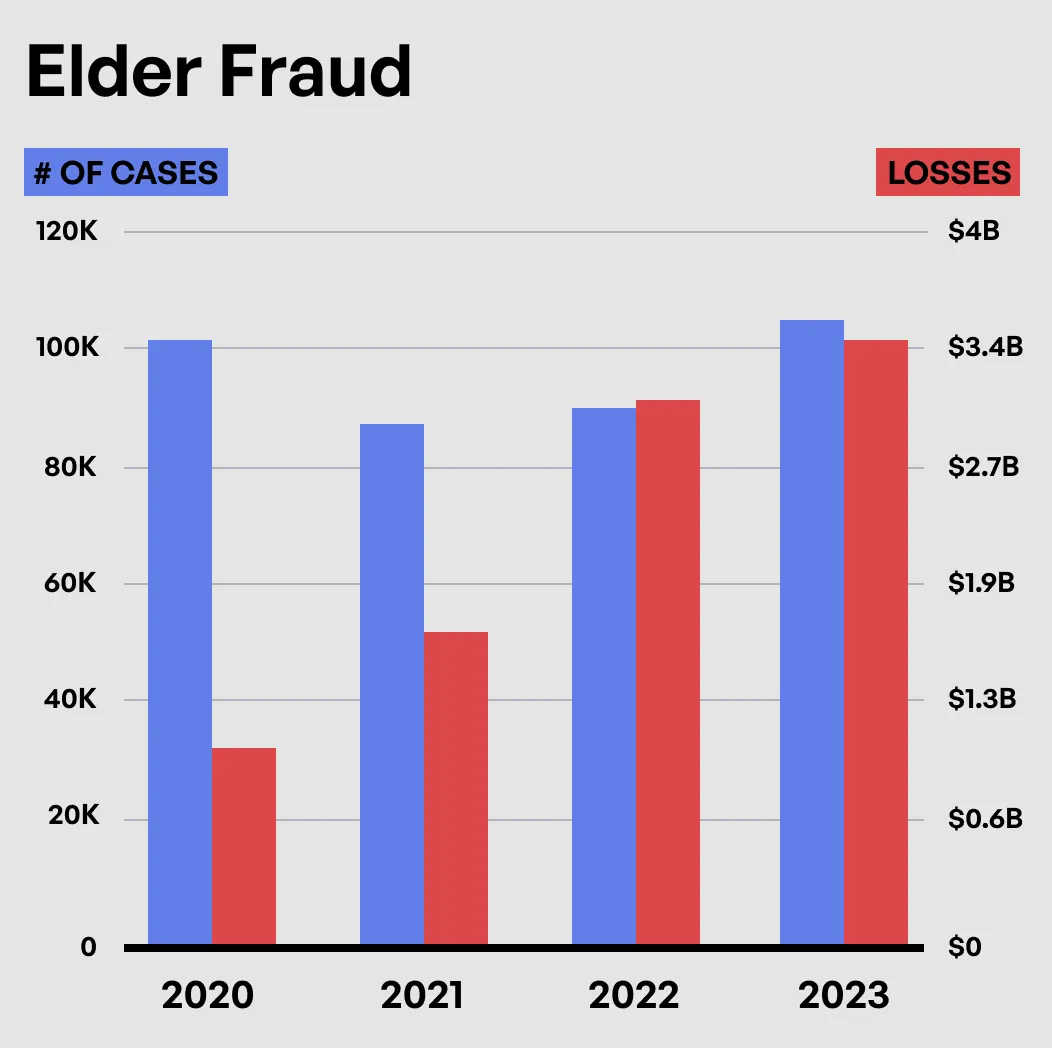

There was a reported $1 billion in fraud against the elderly in 2020. In 2023, that total reached $3.4 billion. Elder fraud jumped by $700 million from 2020 to 2021 and then vaulted another $1.4 billion from 2021 to 2022. Its “growth” was a measly $300 million from 2022 to 2023.

You know the economy’s rough when even the bad guys are in a recession.

For the past four years combined, 387,000 elderly victims lost $9.2 billion, according to the FBI Internet Crime Complaint Center (IC3) reports for 2023 and 2020.

About Elder Fraud

Fraud does not discriminate by age, but it does seem to have a favorite demographic group – the over-60s. During the 2020s, con artists have increased their fondness for the “golden agers.”

In 2020, the FBI reported 105,301 elderly victims with losses totaling over $966 million. Those in the middle-age range (40-59) numbered 177,535 with losses of $1.56 billion. There were 159,155 victims in the “prime wage earner” group (20-39), being defrauded of almost $489,600. As should be expected, the “young sprouts” (under 20) were not attractive targets – 23,186 victims and almost $71 million lost.

By 2023, elderly victims numbered 101,068 with $3.4 billion in losses. Middle-aged targets accounted for 149,976, and almost $3.2 billion was lost. There were 150,548 in the “20-and-30-something” group, losing over $1.5 billion. The teenage victims totaled 18,174 and lost over $40.7 million.

There are actually slightly fewer senior citizens being victimized, according to these numbers, but the amount reaped from the scams has more than tripled.

The 2023 IC3 report notes, “These numbers do not fully capture the frauds and scams targeting this vulnerable cross-section of our population, as only about half of the more than 880,000 complaints received by IC3 in 2023 included age data.”

Elder fraud is not “just about money.” It attacks a vulnerable sector of society and leaves its victims not only much poorer financially but also strips away their dignity and leaves them feeling violated. The FBI states in its report that “some incidents have resulted in suicide because of shame or loss of sustainable income.”

Examples of Elder Fraud

There are still a few old favorites among today’s con artists, but there are also some new wrinkles, so to speak. Two of the “golden oldies” deal with the “love of love” and the “love of money.” The modern twists focus on technology scams and the use of cyber currency.

The FBI calls the old “lonely hearts” scam the “confidence/romance” fraud. A new addition to this genre is the “grandparent scam,” an example of which was the focus of a Daily Muck article in August.

Romance Scams

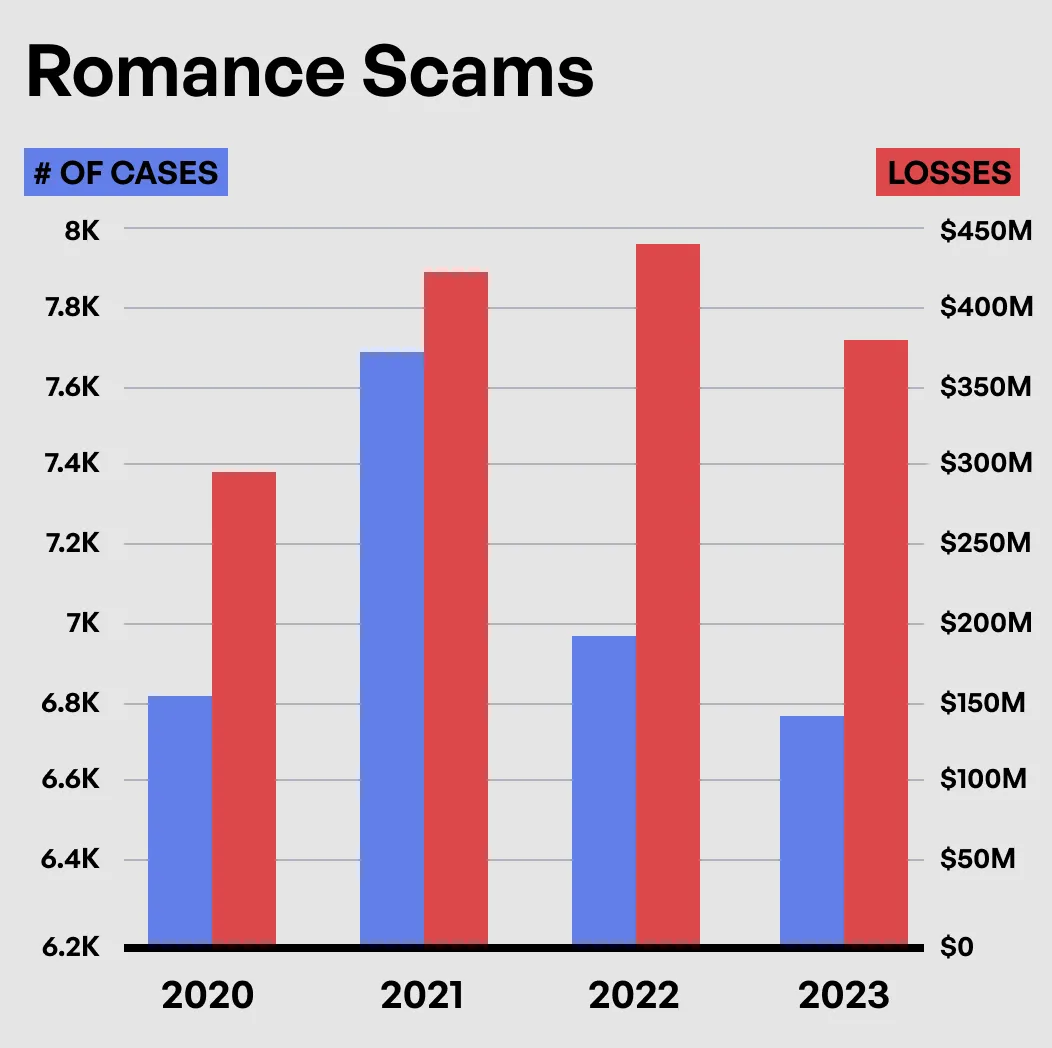

“Confidence/Romance scams encompass those designed to pull on an individual’s

‘Heartstrings,’” the 2023 IC3 report states. “In 2023, the IC3 received reports from 6,740 individuals over the age of 60 who experienced almost $357 million in losses to Confidence/Romance scams.”

The FBI explained that romance scams involve the criminal adopting a fake online identity “to gain an individual’s affection or confidence. The scammer uses the illusion of a romantic or close relationship to manipulate and/or steal from an individual.”

The fraudster establishes a relationship with his “mark” and then asks for money. These con artists may claim to be serving in the military or employed in a U.S. company operating overseas.

“This makes it easier to avoid meeting in person, and more plausible when they request money be sent overseas for a medical emergency or unexpected legal fee,” the IC3 notes.

Romance scams can be a pretext for a much more sinister and long-lasting one – sextortion. The IC3 report says this happens if the victim “has provided illicit pictures to the scammer. In 2023, complainants over the age of 60 reported 3,318 sextortion complaints with reported losses over $6 million.”

Grandparent Scams

The grandparent scams are a new but growing form of fraud. In this fraud, “the criminal impersonates a panicked loved one, usually a grandchild, nephew, or niece of an older person, and claims to be in trouble and needs money immediately,” the FBI said. “In 2023, the IC3 received over 200 complaints from people over the age of 60 reporting Grandparent Scams, with approximate losses of $2.3 million.”

With sophisticated technology, fraudsters can make spoof numbers, so it might seem they are calling from a grandchild’s known phone number. AI can be used to emulate voices on phone calls, and email addresses can be hacked.

Grandparents should be vigilant against these potential scams.

Investment Scams

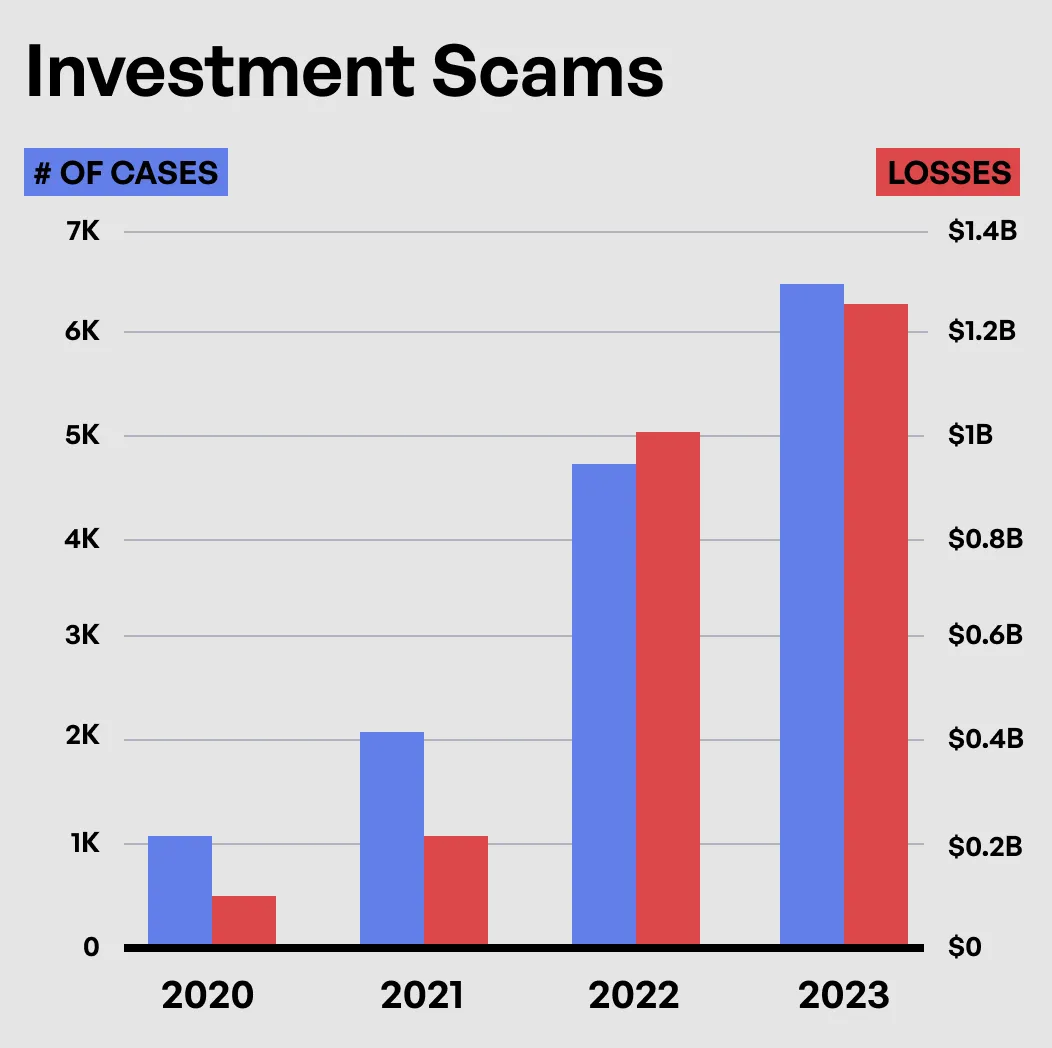

The classic con involves a victim who either “can’t believe his luck” or who believes he and his “investment advisor” have a foolproof plan to “game the system.”

The Grifter’s Motto is simple: “Those who want something for nothing deserve to get nothing for something.” Their goal in life is to make sure their victims “get what they deserve.”

Investment scams were fifth on the 2023 list for the number of claims by elders (6,443) but number one in total losses (over $1.24 billion). The scheme typically involves “complex financial crimes often characterized as low-risk investments with guaranteed returns,” the FBI states.

This group includes “advanced fee frauds, Ponzi schemes, pyramid schemes, market manipulation fraud, real estate investing, and trust-based investing such as cryptocurrency investment scams.”

Call Center Fraud

Most computer users know to ignore the message that pops up on their screens, warning them that their computer is infected with a virus and that their personal financial information is at risk. The message also includes a phone number or website where you can get immediate assistance to protect yourself from those who would do you harm.

But that phone number or website actually connects you to those who would do you harm.

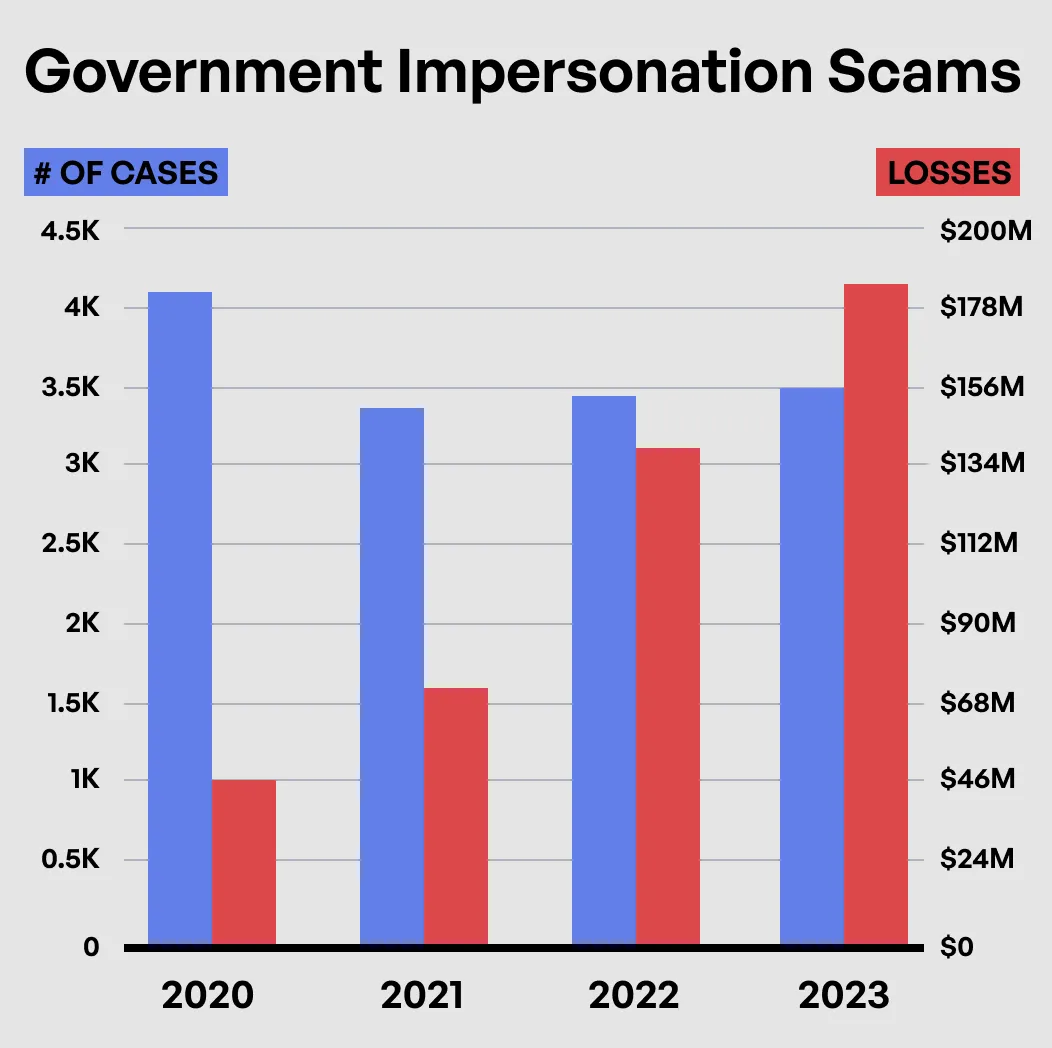

There are two major scams in what the FBI categorizes as “call center fraud.” One is the tech/customer support scheme mentioned above. The other is the government impersonation scam.

Anyone with a phone has most likely received a call from the “Social Security Administration” notifying you of suspicious activity using your Social Security number and that your SSN has been or soon will be suspended unless you respond immediately.

Strange how quickly they hang up if you say there is a printed message on the envelope you just received from Social Security that says the agency will not call you to discuss your Social Security account and to be aware of scammers posing as Social Security agents.

The IC3 report for 2023 explains that “Illegal call centers defraud thousands of people each year” and are responsible “for over $1.3 billion in losses among all complaints reported to IC3.”

Older adults are overwhelmingly targeted. This age group accounted for 40 percent of call center fraud complaints and had 58 percent of the losses from this type of scam.

“Complainants over the age of 60 lost more to these scams than all other age groups combined, and reportedly remortgaged/foreclosed homes, emptied retirement accounts, and borrowed from family and friends to cover losses in these scams.”

People should treat any such calls as potential scams.

Cryptocurrency Scams

The comic book fans out there may know that Superboy’s dog was named Krypto. Like all dogs, Krypto was loving and faithful to his boy. Crypto fraudsters are neither loving nor faithful to anyone but themselves.

Cryptocurrency is a relatively new invention in the financial world. Even a past president who once proclaimed it “highly volatile and based on thin air” has launched a crypto-based venture.

“Most cryptocurrency investment scams are socially engineered and trust-enabled, usually initiating through a romance or confidence scam, and evolving into a cryptocurrency investment scam,” the 2023 IC3 report states. “Criminals often target individuals using dating applications, social media platforms, professional networking sites, or encrypted messaging applications.”

Once again, those members of society generally deemed to be the least tech-savvy are the ones feeling the brunt of this type of fraud. The IC3 received over 15,000 crypto-related complaints in 2023 from victims over the age of 60. Their losses totaled over $1.1 billion.

Most of those losses (64 percent) came in crypto investment scams. The previously mentioned call center scams took 16 percent for second place.

How To Prevent and Report Elder Fraud

The FBI and other government agencies are making a concerted effort to prevent and prosecute this crime. In an April 2024 press release, FBI Assistant Director Michael D. Nordall – head of the Criminal Investigative Division – said, “Combating the financial exploitation of those over 60 years of age continues to be a priority of the FBI. Along with our partners, we continually work to aid victims and to identify and investigate the individuals and criminal organizations that perpetrate these schemes and target the elderly.”

There are certainly some cynical and “grumpy old men” in the elderly citizen category, but as the FBI notes in its report on this topic, “Seniors are often targeted because they tend to be trusting and polite. They also usually have financial savings, own a home, and have good credit — all of which make them attractive to scammers.

“Additionally, seniors may be less inclined to report fraud because they don’t know how, or they may be too ashamed at having been scammed,” the report continues. “They might also be concerned that their relatives will lose confidence in their abilities to manage their own financial affairs.”

Another factor scammers rely on is that “when an elderly victim does report a crime, they may be unable to supply detailed information to investigators,” that report states.

Don’t Be a Victim

Avoiding the possibility of being a statistic in the 2024 IC3 report involves more than just being suspicious of anything that sounds too good to be true or can’t be quickly verified as accurate.

The Department of Justice has a comprehensive fact sheet on this issue. The DOJ discusses the work of the Transnational Elder Fraud Strike Force “to warn and educate the public about trending elder fraud threats. The Strike Force encourages the use of the scheme names listed below to enable those combating financial exploitation to speak a common language in discussing and reporting incidences of elder fraud.”

Earlier, we discussed broad categories of fraud. Here is a synopsis more specific details fraudsters might use within these broader classifications, as categorized by the FBI:

Social Security Administration Impostor Scam

Social Security Administration imposters contact prospective victims by telephone and falsely claim that the victim’s Social Security number has been suspended because of suspicious activity or because it has been involved in a crime. They ask to confirm the victim’s Social Security number, or they may say they need to withdraw money from the victim’s bank and to store it on gift cards or in other unusual ways for “safekeeping.” Victims may be told their accounts will be seized or frozen if they fail to act quickly.

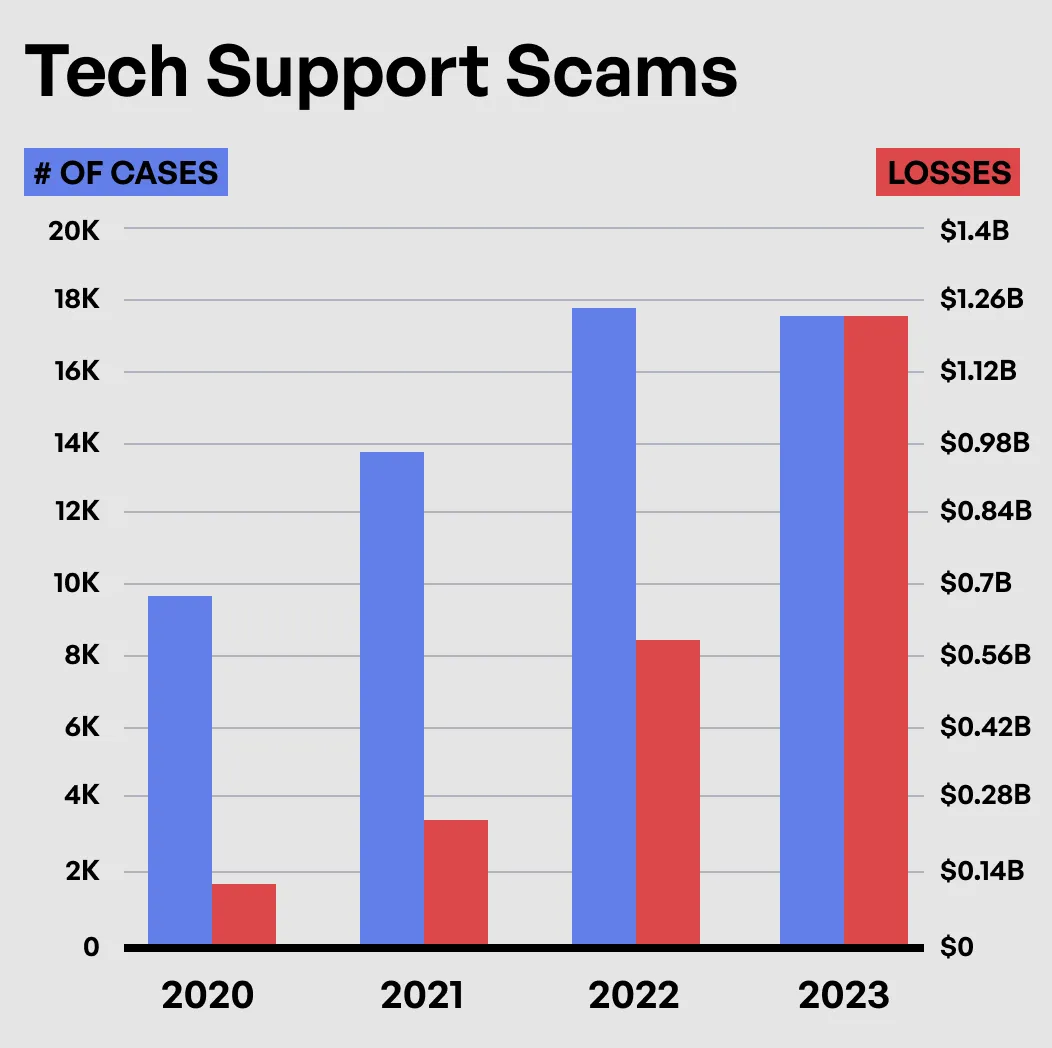

Tech Support Scam

Fraudsters make telephone calls and claim to be computer technicians associated with a well-known company or they may use internet pop-up messages to warn about non-existent computer problems. The scammers claim they have detected viruses, other malware, or hacking attempts on the victim’s computer. They pretend to be “tech support” and ask that the victim give them remote access to his or her computer. Eventually, they diagnose a non-existent problem and ask the victim to pay large sums of money for unnecessary – or even harmful – services.

Refund scheme

After victims make payments, perpetrators often call back and offer refunds to victims, claiming their tech support services are no longer available. Perpetrators claim to send refund money to the victim’s bank account but falsely claim that too much money was refunded. Perpetrators then induce victims to send payments (often through stored-value cards such as gift cards) purportedly to reimburse the tech support company for its “over-refund.”

Lottery Scam

Fraudulent telemarketers based in Jamaica and other countries are calling people in the U.S., telling them that they have won a sweepstakes or foreign lottery. The fraudulent telemarketers typically identify themselves as lawyers, customs officials, or lottery representatives and tell people they have won vacations, cars or thousands — even millions — of dollars. “Winners” need only pay fees for shipping, insurance, customs duties, or taxes before they can claim their prizes. Victims pay hundreds or thousands of dollars and receive nothing in return, and often are revictimized until they have no money left.

The Daily Muck recently featured one such Jamaican ring that targeted a 76-year-old woman in Tennessee. The scheme was foiled when the woman realized it was a scam, contacted law enforcement, and set up a “sting” to catch the fraudsters in the act – complete with a hidden voice recorder. An alert citizen aided police by using his truck to block the scammers from escaping when they tried to evade authorities.

IRS Impostor Scam

IRS Imposter Scams are aggressive and sophisticated phone scams targeting taxpayers. Callers claim to be IRS employees but are not. They use fake names and bogus IRS identification badge numbers. Victims are told they owe money to the IRS, and it must be paid promptly through a wire transfer or stored value card such as a gift card. Victims who refuse to cooperate are threatened with arrest, deportation, or suspension of a business or driver’s license.

Romance Scam

Millions of Americans use dating sites, social networking sites, and chat rooms to meet people. Many forge successful relationships. Scammers also use these sites to meet potential victims. They create fake profiles to build online relationships and eventually convince people to send money in the name of love. Some even make wedding plans before disappearing with the money. An online love interest who asks for money is almost certainly a scam artist.

A Few Tips to Avoid Elder Fraud

The IC3 advises anyone using wire transfers for transactions to:

- Contact the originating financial institution when fraud is recognized to request a recall or reversal and a Hold Harmless Letter or Letter of Indemnity.

- File a detailed complaint with www.ic3.gov. It is vital the complaint contains all required data in the provided fields, including banking information.

- Never make any payment changes without verifying the change with the intended recipient; verify email addresses are accurate when checking email on a cell phone or other mobile device.

Other tips to avoid being a victim include:

- Don’t give out personal information over the phone or in response to an email or other message.

- Never click on emailed links or attachments, even if the email appears to be sent by someone you know, unless you first verify that the email was in fact, sent by that person. Email messages that appear to be from known contacts can be phishing attempts to gain your personal information.

- Be wary of individuals who demand payment upfront or in a specific format (e.g., wire, Venmo/CashApp/Zelle, gift cards, cryptocurrency).

- Check incoming bills for charges that you did not authorize

- Take your time and reject high-pressure approaches from individuals you do not know.

And, of course, never believe you won a lottery or sweepstakes that you didn’t enter. Also, how many of us really have a long-lost wealthy relative that we didn’t know about but who knew about us and left us their entire estate?

Why Are the Elderly Targeted?

In its March 20, 2024, report, the National Institute of Justice looks at possible reasons why the elderly are more susceptible to fraud than younger Americans. It emphasizes that even though research indicates “older adults are more likely to be targets of fraud than younger adults,” that does not necessarily mean they are defrauded at higher rates than others.

The report points out that the number of fraud victims of all ages is considerably lower than the reported incidents.

The NIJ notes that “changes in the aging brain and declines in cognitive functioning (ranging from mild impairments to Alzheimer’s disease and dementia) make older adults more susceptible to scam and fraud. Other risk factors include a lack of financial literacy, social isolation, and loneliness.

“Older adults also tend to be more trusting than younger adults and less able to recognize deceitful individuals,” the report adds.

The NIJ cited a 2016 Health and Retirement Study that reported 34.8 percent of persons over 50 “had been targeted by or had been the victim of a fraud or investment scam in the past five years.”

The report said fraud victimization “may be more severe for older adults than younger adults. Research found that they lose more money, on average, than younger victims.

“Financial fraud of older adults is rarely handled through the criminal justice system,” the NIJ continued. “Older fraud victims are unlikely to report the incident to the police. Prosecutors and law enforcement may be less interested in pursuing legal action when the victim is an older adult, especially one who has cognitive difficulties.”

Report Fraud

A major weapon in the war against elder fraud – and a key tool in efforts to recover lost money – is the Elder Fraud Hotline, established in March 2020. The DOJ’s Office for Victims of Crime says the hotline receives about 83 calls a day.

“The hotline, managed by OVC, is staffed by caring professionals who will treat you with dignity and respect,” the OVC website states. “Callers will be assigned a case manager, who will remain their point of contact. A case manager will assist you with reporting the crime and connect you with other resources as needed.”

If you or someone you know is a victim of elder fraud, call the National Elder Fraud Hotline at 833-FRAUD-11 (833-372-8311). The hotline is open Monday through Friday from 10:00 a.m. to 6:00 p.m. Eastern Time and is available in English, Spanish, and other languages.

You can also contact your local FBI field office, submit a tip online at tips.fbi.gov or file a complaint with the FBI’s Internet Crime Complaint Center at ic3.gov.

Baby Boomers (which includes this reporter) need to realize this isn’t the “Happy Days” of the 1950s, the “Flower Power” of the 1960s or even the “Disco Fever” of the 1970s. Be alert, be suspicious, be cautious, and maybe even be a little rude if need be. Above all, don’t be a victim.

For more in-depth reports and features on this and other important topics, subscribe to The Daily Muck.

Reprint and Permissions

Email

info@dailymuck.com

The Daily Muck grants permission to other publications and individuals to use our articles, images, and content,

provided that proper credit is given by linking back to the original source at https://dailymuck.com.

To request additional permissions or for any inquiries, please contact us at info@dailymuck.com.