Feds Charge “Rug Pullers” in Largest NFT Scam in History

Feds have charged Gavin Mayo and Gabriel Hay, both 23 and from California, with offenses surrounding a purported NFT scam.

Gavin Mayo of Thousand Oaks, Calif. and Gabriel Hay of Beverly Hills, Calif., both 23, sponsored several NFT and other digital asset projects, which they promoted then abandoned. Prosecutors say Mayo and Hay falsified and influenced others to falsify statements about these digital assets, according to court documents. The scam started around May 2021 and lasted until May 2024.

The two men face up to 65 years in prison for two counts of wire fraud, conspiracy to commit wire fraud and stalking.

False Claims and Harassment

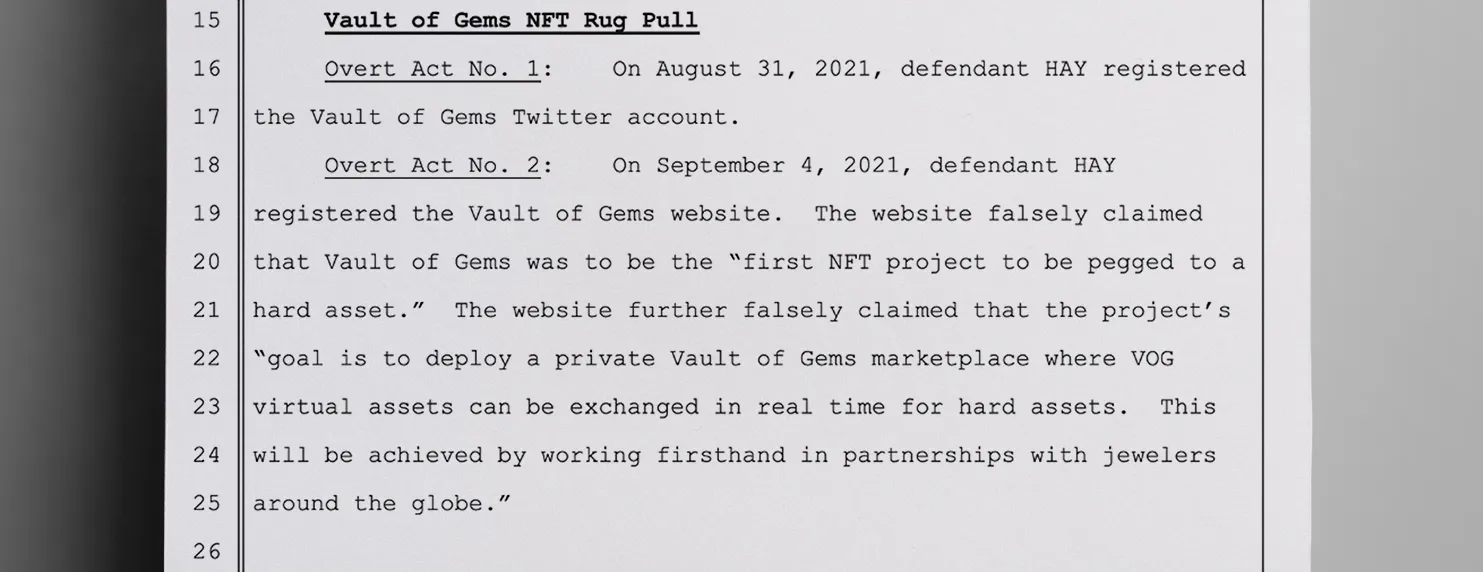

While promoting the Vault of Gems NFT project, Mayo and Hay claimed the project would be “the first NFT project to be pegged as a hard asset” and then abandoned it when they collected millions in funds from investors, according to an indictment obtained by The Daily Muck.

In addition to the Vault of Gems NFT project, May and Hays allegedly used the same tactics with digital assets known as Faceless, Sinful Souls, Clout Coin, Dirty Dogs, Uncovered, MoonPortal, Squiggles and Roost Coin, say prosecutors.

They also started a harassment campaign against the project manager by sending messages to this person and their parents with the sole purpose of intimidating him and his family and causing them distress, according to the indictment.

What is an NFT?

A Non-Fungible Token is a unique digital asset stored on a blockchain, representing ownership of items like digital art, music or even virtual real estate.

Unlike cryptocurrency, NFTs are non-fungible, meaning each is one-of-a-kind. However, like cryptocurrency, NFTs are susceptible to scams due to their speculative and unregulated nature.

What is a Rug-Pull Scam?

A “rug pull” is a common scam in cryptocurrency and NFTs in which developers create a project, generate hype around it and then abandon it after collecting money from the investors.

Statements by Officials

In a statement accompanying the Justice Department press release, Principal Deputy Attorney General Nicole M. Argentieri said Mayo and Hay defrauded investors of more than $10 million.

“Fraudsters take advantage of new technologies and financial products to steal investors’ hard-earned money,” Argentieri said.

Homeland Security officials participated in the investigation and also weighed in with comments in the press release.

“For three years, Hay and Mayo apparently lied to their investors in order to defraud them out of millions of dollars,” said HSI Executive Associate Director Katrina W. Berger. “Such technological fraud schemes cost investors millions of dollars every year.”

Discover More Muck

First AI-Powered Lawsuit Exposes California’s Eco-Fraud Empire

Feature John Lynn | Apr 10, 2025

Weekly Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.

Weekly

Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.