Investment Advisors Stole $100 Million, Plead Guilty to RICO Charges

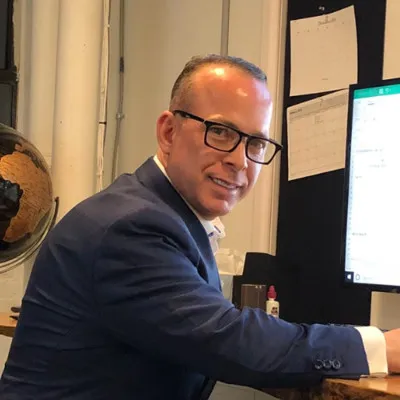

Joseph LaForte (shown here) and his brother, James LaForte, have pleaded guilty to RICO charges in an investment scam. Photo credit: LinkedIn.

The pair used a company officially named Complete Business Solutions Group– but doing business as “Par Funding”– to generate over $100 million in illegal proceeds, according to a public statement by the U.S. Attorney’s Office, Eastern District of Pennsylvania.

The LaFortes operated Par Funding from 2013 until July 2020, according to the indictment. In 2020, the Securities and Exchange Commission (SEC) intervened and replaced the LaFortes with a court-ordered receivership to avoid the further loss of investor dollars.

The feds filed an emergency action and a temporary restraining order, and an asset freeze was issued to stop the fraudulent scheme that has raised nearly half a billion dollars from an estimated 1,200 investors nationwide, according to an SEC complaint.

Tax Crimes Blossomed into RICO Charges

The Lafortes were initially indicted for allegations of tax fraud, primarily for underreporting their income to the state of Pennsylvania by claiming to be residents of Florida, which has no personal income tax and relatively low corporate taxes.

The original tax crimes blossomed into a superseding indictment that included an extra 25 pages of additional tax and conspiracy charges.

Among the allegations are that the Lafortes threatened borrowers with violence if they did not repay their loans, according to the U.S. Attorney’s statement.

Misinforming Investors

Par Funding loaned businesses money against their future accounts receivable, charging interest of around 30%, according to the indictment. These types of short-term loans are known as “merchant cash advances.” Sometimes, customers would “reload” these loans to get additional cash and roll them over into new loans, which, of course, meant additional interest. Sometimes, that interest was three or four times the loan amount.

To get funds to loan, the LaFortes solicited money from investors. That’s where they committed their second cluster of crimes, by misinforming their investors on critical topics such as Par Funding’s underwriting process, portfolio diversity, default rate, profitability and business insurance, according to the press release.

Par Funding Operations

Joseph served as the president and the CEO of the organization and ran Par Funding’s day-to-day operations, while James worked in sales and collections with managerial authority.

James LaForte also pleaded guilty to the extortionate collection of credit from a Par Funding merchant customer, as well as obstruction of justice for assaulting the Philadelphia attorney and retaliation for threatening several government witnesses.

Per the agreement, Joseph LaForte will serve between 13.5 and 15.5 years in prison, while James LaForte will spend between 9 and 11.5 years behind bars. Joseph also agreed to pay millions of dollars in restitution.

Discover More Muck

American Multinational Company Fined $122 Million for Bribing South African Officials

Report Strahinja Nikolić | Jan 14, 2025

Woman Steals $3 Million, Will Serve 3 Years, Then 3 Years of Supervised Release

Report Strahinja Nikolić | Nov 12, 2024

Weekly Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.

Weekly

Muck

Join the mission and subscribe to our newsletter. In exchange, we promise to fight for justice.